What are the pros and cons of a Current Account?

Pros and cons of paid-for current accounts

- Pros:

- 1) It’s often cheaper than buying the benefits separately.

- 2) Monthly costs start low.

- 3) You might be surprised by the benefits on offer.

- Cons:

- 1) The fee might not be worth the benefits.

- 2) Insurance policies may have exclusions and limits.

- 3) They may not suit the overdrawn.

Then, How much does current cost a month?

Current Features

| Minimum Deposit | $0 |

|---|---|

| Maintenance Fees | $0/mo |

| Branches | None (online-only) |

| ATM Availability | 40,000 Fee-Free Allpoint ATMs in the U.S. |

| Out-Of-Network ATM Fee | $2.50 |

• May 3, 2022

Can I withdraw money from current account?

Advantage of Current Bank Account

The businessmen can withdraw from their current accounts without any limit, subject to banking cash transaction tax, if any levied by the government. Home branch is that location where one opens his bank account.

How much cash can I withdraw from current account?

The limit on weekly withdrawals from current account was raised to Rs 1 lakh earlier this month from the Rs 50,000 set just after the November 8 announcement. RBI said that the Rs 24,000 limit on withdrawals from savings accounts per week could also be relooked.

Can I deposit cash in current account?

You can deposit cash in your current account using any of the following methods: Depositing cash at any of the branches of your bank. Cheque deposits. Electronic transfers.

Do you need a bank account for current?

No account fee: Both the Current and Teen accounts are free for users. Mobile check deposit: Not all online banks offer mobile check deposit, but Current does.

How do I deposit cash into my Current Account?

Here’s how it works:

- Open the ‘Money Tab’ in your Current app and click on the ‘Cash’ section.

- Select ‘Deposit’ and find a store near you on the map.

- At the store, tell the cashier you’d like to deposit cash.

- Generate a barcode in the Current app (with one tap!) and give to the cashier to scan.

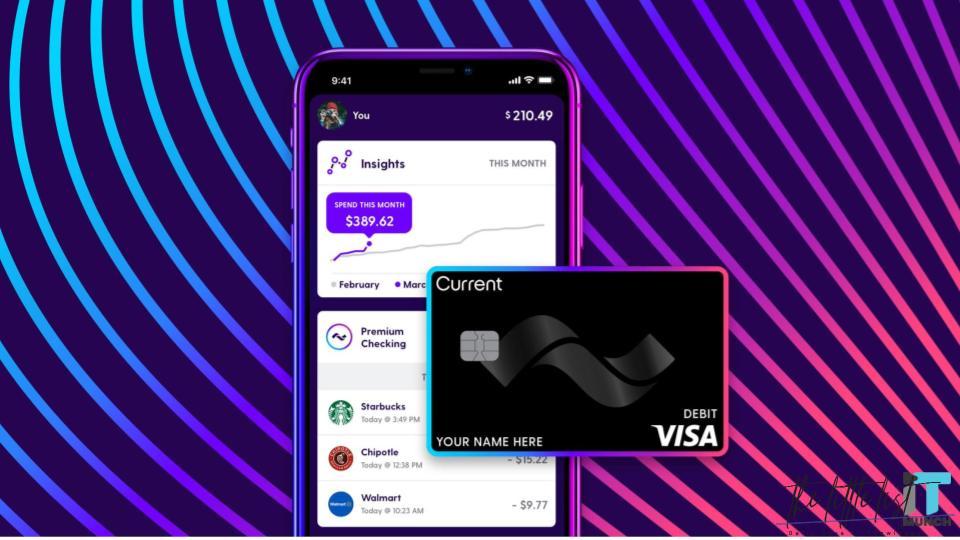

Does current send you a card?

Since your Current card is typically delivered within 7-10 business days of being issued, here are some ways for you to access your funds and add money to your account while you wait for your card to arrive: Add your virtual card to services like Apple Pay and Google Pay or use it to shop online.

What are the disadvantages of current account?

- (1) No Interest on Deposits.

- (2) High Cost of Bank Services.

- (3) Limit of Free Cheque Books and Free Demand Drafts.

- (4) Cap on Free Cash Deposits & Free Cash Withdrawals.

- (5) Higher Amount of Monthly Account Balance Maintenance.

- (6) Confusing Fine Print.

- (7) Transaction Fees.

- (8) Bill Payments cannot be Automated.

What is limit in current account?

| Description of Charges | Max Current Account |

|---|---|

| Bulk Transaction limit | All above transaction are subject to a maximum of 500 transaction per month beyond which charges @ Rs.10/- per transaction would be levied. Includes all Local/Anywhere clearing & Funds transfer transactions |

| Remittance facility through other Bank |

Is ATM card available for current account?

Yes. All Banks offer ATM CARD for their current account holders.

Can I use current account for personal use?

As mentioned above, a current account is an account meant for business. Unlike savings accounts that cater to individuals who want to save money, current accounts are mainly used to service the needs of the businesses.

Which bank is best for current account?

Best Banks for Current Account

| Banks | Maximum Cash Deposit Allowed |

|---|---|

| State Bank of India (SBI) | No limit |

| HDFC Bank | Up to ₹2 lakhs per month (for regular current account) |

| ICICI Bank | Up to ₹1.8 crores per month |

| Axis Bank | Up to ₹2 lakhs per month (for regular current account) |

Does current account have ATM card?

Yes. All Banks offer ATM CARD for their current account holders.

How much is the maximum amount in current account?

Since the money in current accounts are used for business transactions, there is no limit to the amount of money that a current account can carry in Nigeria. Depending on the bank, they would require individuals use the minimum balance of ₦5,000 to open a current bank account and ₦10,000 for corporate.

Does current ask for SSN?

Yes, Current requires a U.S. Social Security Number (SSN) to open an account. Your Social Security Number helps us validate your identity and protect your platform.

How do I withdraw money from my Current Account?

You can visit your bank and fill out a form with your account information and amount you want to take out and present it to a teller. Work with a bank teller. Let the teller know you don’t have a card, and they can walk you through the bank’s process of retrieving money from your account.

Can you deposit checks with current?

With Current, mobile check deposit comes standard. Simply take a picture of your check in the Current app and we’ll add the funds to your banking account.

What ATMs can I use with current?

As a Current Account member, you can withdraw your money without any fees at over 40,000 in-network Allpoint ATMs in the U.S.

How much cash can I deposit in Current Account?

The account provides 25 free transactions per month and offers a free cash deposit facility of up to Rs. 2 lakhs in home branch and Rs. 1 lakh in other branches.

Is current better than chime?

As far as Chime vs Current, Chime is the winner in terms of interest rate. Chime offers a whole 1% interest on all balances, while Current pays nothing at all. Chime makes up for this disadvantage by having lower fees and offering higher ATM withdrawal limits compared to Current.

Whats better chime or current?

As far as Chime vs Current, Chime is the winner in terms of interest rate. Chime offers a whole 1% interest on all balances, while Current pays nothing at all. Chime makes up for this disadvantage by having lower fees and offering higher ATM withdrawal limits compared to Current.

What is current deposit limit?

Current deposits are insured through Current’s partner bank, Choice Financial Group, Member FDIC. This means they have the standard insurance coverage limit of $250,000 per depositor. That is 240,000 more than you need as you can’t actually hold more than $10,000 in your Current account.

How can I withdraw money from my Current Account without my debit card?

How Can I Withdraw Money From My Checking Account Without a Debit Card?

- Cash a check at your bank. This involves writing a check for the amount you need and visiting a bank branch to retrieve funds.

- Cash a check at a store.

- Use a withdrawal slip at a bank branch.

- Work with a bank teller.