Does current give cash advance?

We don’t provide cash advances, but with our Overdrive feature, you can overdraft up to $200 with no additional fees!

Then, Do you need a bank account for current?

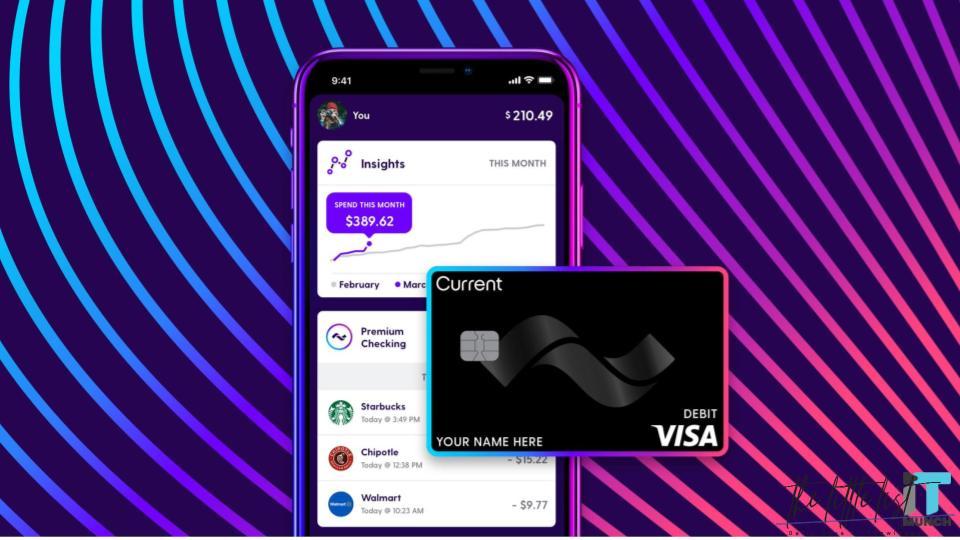

No account fee: Both the Current and Teen accounts are free for users. Mobile check deposit: Not all online banks offer mobile check deposit, but Current does.

How do I borrow $100 from Cash App?

How To Borrow Money From Cash App Borrow

- Open Cash App.

- Tap on your Cash App balance located at the lower left corner.

- Go to the “Banking” header.

- Check for the word “Borrow.”

- If you see “Borrow,” you can take out a Cash App loan.

- Tap on “Borrow.”

- Tap “Unlock.”

- Cash App will tell you how much you’ll be able to borrow.

Can you borrow money with current?

Current U.S. Bank customers with credit approval can borrow up to $50,000 2 with our personal loan. Get perks for your everyday spending with a U.S. Bank credit card. Find the card that best fits your lifestyle and earn cash back, rewards, travel benefits and more.

How can I get 50$ on my current?

New Current members can receive a $50 bonus after doing the following:

- Sign up for a Current Account using the advertised campaign link.

- Enter the code WELCOME50.

- Add a qualifying direct deposit of $200 or more within 45 days.

How do I put money on my current card?

Instantly add cash to your account

- Open the Current app and go to the Money tab.

- Find a location near you on the ‘Add Cash’ map.

- Generate a barcode and hand it with your cash to the cashier.

- Funds are instantly available in your account.

Where can I put money on my current card?

We’re happy to announce that Current’s over 1 million members now have the ability to add cash instantly to their accounts at over 60,000 stores nationwide, including CVS Pharmacy, 7-Eleven, Dollar General and Family Dollar. Paid in cash? No need to even visit an ATM to deposit your money.

Does current ask for SSN?

Yes, Current requires a U.S. Social Security Number (SSN) to open an account. Your Social Security Number helps us validate your identity and protect your platform.

What app will give me money instantly?

1. Earnin – Best for hourly workers. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached. When users sign up for the app, Earnin connects their bank accounts to verify their payment schedules.

What apps will let me borrow money instantly?

Here are five apps that let you borrow against future earnings, and some less expensive options to consider.

- Earnin: Best for low fees.

- Dave: Best for small advances.

- Brigit: Best for budgeting tools.

- Chime: Best for overdraft protection.

- MoneyLion: Best for multiple financial products.

Can PayPal lend me money?

The process is easy: Select your loan amount. The maximum loan amount depends on your PayPal account history. Choose the percentage of your PayPal sales that will go toward repaying your loan and fee.

Can you overdraft with current card?

Current lets you overdraft up to $200¹ with no overdraft fees, so you’re covered. Just set up direct deposit, receive a qualifying deposit, and enable Overdrive™ on your Current Account.

What loan apps work with current?

Here are the best borrow money and paycheck cash advance apps you can use right now:

- Wealthfront Cash Account. Wealthfront is one of the best robo-advisors out there.

- Chime.

- Empower.

- Axos Bank Direct Deposit Express.

- Earnin.

- DailyPay.

- PayActiv.

- FlexWage.

How can I get free money from current?

Current Bank will give you $50 when you join and open a Premium Checking account. Enter the Current Promo Code WELCOME50. Connect a Payroll Direct Deposit of $200 or more within the first 45 days of opening your account.

How do I get free money?

How to get free money now: 15 Ideas

- Take advantage of your employer’s 401(K) match at work.

- Get paid interest on your savings.

- Get free money when you watch TV or use the internet.

- Earn free money while you shop online and in-store.

- Get free money now with refunds from Paribus.

- Use apps to track and save your money.

How fast is direct deposit with current?

We designed our banking system specifically so you can get paid up to two days early, as opposed to traditional banks.

How much cash can I deposit in Current Account?

The account provides 25 free transactions per month and offers a free cash deposit facility of up to Rs. 2 lakhs in home branch and Rs. 1 lakh in other branches.

Does current have a monthly fee?

No surprise charges. At Current, we believe in our members spending their hard-earned money on the things that matter most to them. We have no hidden fees², no overdraft fees, no minimum balance fees and no fees when you transfer money to other members on Current using your Current ~tag.

Does current card work with Cash App?

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported, but depositing to these cards does not work. ATM cards, Paypal, and business debit cards are not supported at this time.

Does current card work with cash App?

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported, but depositing to these cards does not work. ATM cards, Paypal, and business debit cards are not supported at this time.

Can the government track prepaid cards?

No. The Debit Cards are actually controlled by a private bank, called MetaBank. Federal laws prevent the government from tracking the financial transactions of citizens, without written permission, “except under limited circumstances.”

What is the easiest bank account to open online?

Following is a partial list of banks that can open an account entirely online, with no need for a customer to visit a branch.

- BayVanguard Bank*

- Altamaha Bank.

- Androscoggin Bank*

- Axos Bank*

- BankFive.

- Bank of America*

- Bank of Travelers Rest.

- Bank Independent*

What can someone do with the last 4 digits of your SSN?

As long as a hacker or scammer has access to other personal information such as your name and address, they can use the last four digits of your SSN (in most cases) to open accounts in your name, steal your money and government benefits, or even get healthcare and tax refunds in your name.

Can I borrow money on venmo?

How to Borrow Money from Venmo? Yes, you can borrow money from Venmo and get Venmo loans up to $5,000. And much like regular bank loans, Venmo will take a small amount from your cash balance every month as an interest fee until you fully pay the loan back.

What app lets you borrow money without direct deposit?

Earnin is an app that allows you to borrow. The application will likely then withdraw extent you use from your own checking account when you obtain the next immediate deposit. Cash loan apps enable you to put revenue you generated at the office into your account very early.

How can I borrow money online instantly?

6 places to borrow money online instantly

- MoneyMutual. Short-term payday loans of up to $5,000 are available.

- CashAdvance.com. A 0 to $1,000 payday, loan online as well as installment loans.

- CashUSA.com. The loan amount might range from $500 to $10,000.

- CreditLoan.com.

- BadCreditLoans.com.

- PersonalLoans.com.