Why is my debit card declined when I have money online?

Even if you have money in your account, your debit card can be declined for a number of reasons. The bank could have blocked the card for fraud prevention, the store may not accept your card type, the card could be damaged or have expired or you may have entered the wrong PIN.

Then, Why my debit card is not working for online payment?

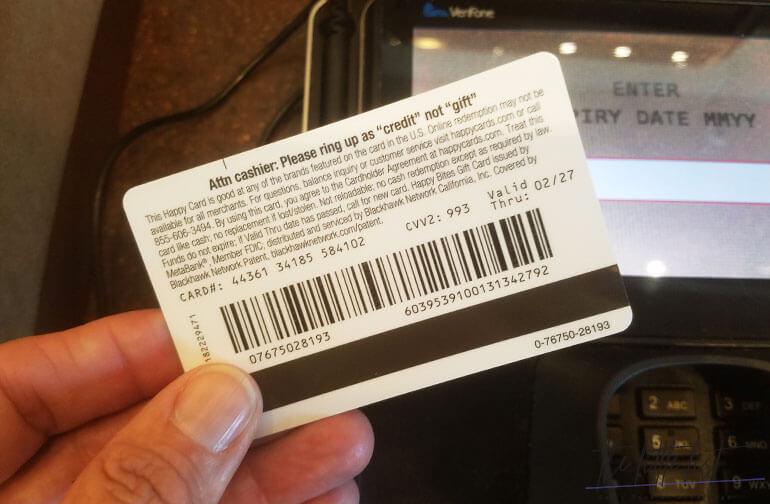

Please check the reasons below to avoid debit card transaction failures: Card details entered are incorrect ( Card number, card expiry and CVV) Incorrect OTP / Incorrect VBV Verified by Visa password. Make sure you have your registered Mobile number with you as OTP will be delivered on the registered number only.

How do you fix a declined debit card?

Usually, this involves contacting your bank or credit card company to fix the issue.

- Figure out the reason for the decline. Once the declined payment happens, your credit card company or bank may share the reason for the decline with us.

- Contact your credit card company or bank.

Why is my Visa debit card not working online?

A Virtual Visa Debit transaction may be declined for the following reasons: Funds are not available in your account(3). You may have exceeded the transaction limits. applicable to your account.

How do I Unrestrict my debit card?

Generally, there are two ways for unblocking the ATM card – either the banks do it automatically or you have to request the banks online, through SMS/call, or by paying a personal visit at the branch. This depends on the cause of the card block and whether it is a temporary card block or a permanent one.

Why isn’t my Visa debit working?

The most common reasons are that the card hasn’t been activated, the cashier is running the wrong type of transaction, the dollar amount being charged is greater than the card’s balance or the credit card processing machine is bumping up the charge amount to either place a hold on the card or to allow for a gratuity.

Why won’t my bank card let me order online?

You entered your card information incorrectly. You have an old address or phone number still on file. You reached your credit limit. Your card has expired.

Why is my credit card declining when I have money?

1. You Reached Your Credit Limit. Your card can be declined if you’ve hit the card’s credit limit, or the upper threshold of charges you can put on the card. It’s your bank’s way of saying you cannot borrow any more money until you make a payment.

Why does my debit card keep getting restricted?

Normally debit cards can be blocked if there is fraud on the account so the fraudster can’t do any more damage to your account. However, there can be times where your card gets blocked because the store you went to has had a high volume of fraudulent charges made at the specific location.

Why did my card get restricted?

When an ATM screen shows your card as restricted, that means your bank is hard at work protecting you from fraud or some other problem. Banks, credit unions, brokerage accounts and other debit card issuers take great pains to prevent fraud, and you are the beneficiary of their problem-detection systems.

What does code 62 mean?

The customer’s card issuer has declined the transaction as the credit card has some restrictions. The customer should use an alternate credit card, or contact their bank.

Why is my bank declining payments?

There is a large number of reasons why a credit card may be declined, from there not being enough funds available on the card, to the card being expired, the billing address being incorrect, etc.

Why is my US bank card declining?

General decline reasons:

Attempts to exceed your daily transaction amount. Check your transaction activity to see your available funds. Possible magnetic strip damage (in this case, you’ll need a new card.) PIN was entered incorrectly.

Why is there a restriction on my bank account?

Banks may freeze bank accounts if they suspect illegal activity such as money laundering, terrorist financing, or writing bad checks. Creditors can seek judgment against you which can lead a bank to freeze your account. The government can request an account freeze for any unpaid taxes or student loans.

What does code 51 mean at WalMart?

The customer’s card issuer has declined the transaction as the credit card does not have sufficient funds.

What is declined 200?

200/652. Transaction was declined by processor. Decline. A processor decline indicates that the customer’s bank has refused the transaction request. Sometimes you can tell why it was declined by reading the response code, but only the customer’s bank can confirm the specific reason.

What declined 05?

Do not Honor (05) is the most common and general message for card transactions that are declined by the Bank. It indicates that the Issuing Bank will not validate the transaction. It is caused by many factors such as mistyping, insufficient funds, etc.

How do I know if my bank account is restricted?

Bank Placed Restrictions

If your account has been overdrawn due to insufficient funds, the bank likely will restrict your account. You can deposit funds but not withdraw them. Any checks written or pending purchases against the account may be declined.

How long can a bank restrict your account?

An account freeze resulting from an investigation will usually last for about ten days. However, there’s no set limit for how long a freeze may last. A bank can effectively suspend your account at any time for as long as they need to in order to complete a thorough investigation.

How do you know if my bank account is blocked?

How Do You Know if Your Bank Account is Frozen? If you have a frozen bank account, you won’t be able to use your ATM and Credit/Debit cards as well. Each time, you’ll see an error message on the screen, and any transaction that you make will fail to process.

What does Bob mean at Walmart?

They wrote: “Someone left out the secret codes for catching shady customers at Walmart.” If an employee asks a colleague, “Have you seen Bob?” it’s a reminder to check the bottom of a customer’s basket.

What is a code 15 at Walmart?

These codes can be used to direct security to certain areas of the store or alert them to security issues. There are also Security Codes 15 and 60, which can be used to tell security that a section of the store will be unattended for the next 15 or 60 minutes. What is this?

Why is Walmart declining my card?

Soft declines are rejections of credit card authorizations from the issuing banks for online orders due to generic issuer errors such as server timeout or issuer unavailability. They occur when Walmart’s backend system starts sending payment attempts to payment gateways.

Why do online payments fail?

From the customer’s side payment failure can be caused simply because there is a poor connection or due to inputting incorrect details, inputting incorrect OTP, passwords, or due to lack of sufficient funds in the customer’s account.

What Does not approved 27 mean?

27. A fraud filter has blocked this transaction.

What does pick up card error mean?

What does pick up card mean? The error message “Pick up card” means that the customer’s bank has declined the transaction as the issuer wants to retrieve the card. If you can do it safely, you are advised to keep the card.