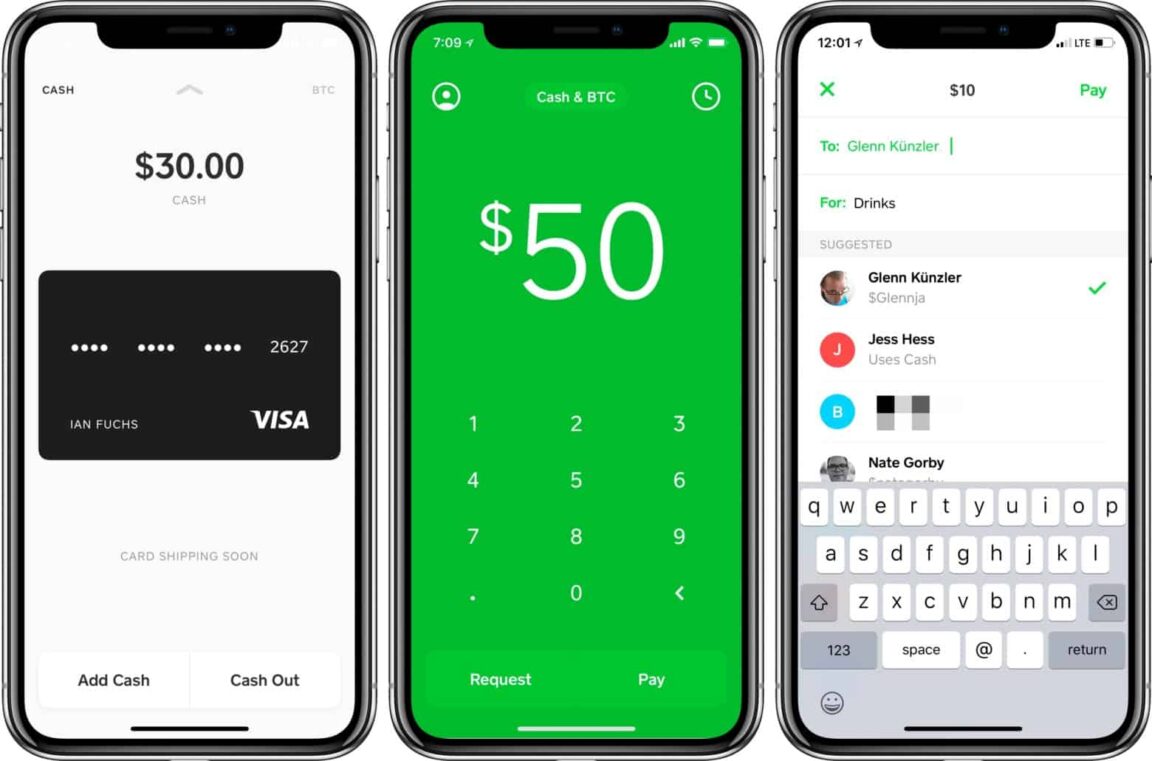

Is Venmo or Cash App better?

If you want to use a digital wallet to transfer funds between friends and family, Venmo might be the better choice. The interface is simple, transfers are straightforward and you can keep track of payments via its social networking feature. For expanded functionality and features, you’ll likely favor Cash App.

Then, What is safer Venmo or Cash App?

Both Cash App (review) and Venmo are Peer-to-Peer (definition) payment apps in the US that let you pay your friends, family, and trusted businesses easily without the big fees (as we discuss below). Both are also equally safe to use as long as you stick to some basic personal finance habits.

Is Zelle Cash App Safe?

“Zelle is safe because it uses data encryption which offers users increased protection. From a privacy perspective, it’s safer than alternatives, like Venmo and Cash App, since it’s harder for scammers to access users’ personal information,” said Nishank Khanna, chief marketing officer at Clarify Capital.

Can I Zelle to Cash App?

It is not possible to directly transfer money from Zelle to Cash App and vice versa. However, you can use your bank to remit funds from Zelle to the Cash App. In this case, you need to have a bank account that links to both Cash App and Zelle.

Should I use PayPal or Cash App?

Cash App is the best way to send and receive payments locally. PayPal is the best way to send and receive payments locally and internationally. PayPal is also a better option for merchants.

What are the disadvantages of Cash App?

Drawbacks: There’s a fee to send money via credit card. Cash App charges a 3% fee to people who use a credit card to send money. A fee for instant deposits.

Can someone hack your Cash App with your name?

Yall better stop putting y’all names under these cash app threads . They’re are cash app scammers taking your names and hacking into your accounts and stealing money! Cash app never ask for your code though via email, txt, calls, none of it. Never enter your pin unless you are sending money through the app.

What banks work with Cash App?

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported, but depositing to these cards does not work.

Which is better Venmo or PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice. Sign up for Venmo now.

Can I send money from PayPal to Cash App?

Open the PayPal app and tap on Transfer in the balance section. Type in the amount you want to transfer and select the bank account to which you want to send the money. This account should be the one linked to your Cash App as well. Tap the blue Transfer button at the bottom of the page.

Can I send money from Venmo to Cash App?

You Are the Link

Unfortunately, the one thing you can’t do is send money from your Venmo account to another person’s Cash App account. However, if you have personal accounts on both apps, neither Venmo nor Cash App have rules that would make transfers from one service to another impossible.

What bank does Cash App use?

According to the latest updates, Lincoln Savings Bank is announced as the official bank for the Cash App payment Application. Lincoln Savings Bank stored, maintained, and controlled all funds in the Cash App in a highly supervised and secure manner.

Which is safer Zelle or PayPal?

However, while Zelle may appear more secure, applications like Venmo and PayPal are just as secure. All of them use data encryption to protect users against unauthorized transactions and store users’ data on servers in secure locations. Venmo also offers users the ability to set a PIN code for access to the mobile app.

Do you need a bank account for Cash App?

You can set up Cash App without a Bank Account, but you will face some drawbacks. Users can get money off Cash App without a typical credit or debit card by using a Cash App Card. Cash app allows for money withdrawal and other services without a bank account or card.

Should I use PayPal or Cash App?

The main difference between Cash App and Paypal is that Cash App is a fee-free service while PayPal offers a range of diverse services which means the fee structure is also diverse. Cash App and PayPal are two of the most popular financial service providers in the United States.

Why you shouldn’t use Cash App?

Although the app is legitimate, you should use it cautiously. Scammers have found ways to defraud people using the app, so only send and accept money from people you trust.

What’s the catch with Cash App?

The scammers will tell you that you won a cash prize in a separate giveaway, but there’s one catch: you need to send THEM a small amount of money first to verify your identity so that you can claim the large cash prize. Once you send them money, the account blocks you and you’re cash is gone.

Can you get scammed on Cash App sugar daddy?

Scammers create this “temporary payment” in one of two ways. They may choose to use stolen credit card funds to pay the sugar baby. The money does land in the baby’s account, but once the credit card company realizes that the card was stolen, they’ll take the money back and leave the victim with nothing.

Will Cash App refund stolen money?

Will cash app refund money if scammed? Yes, Cash App will refund your money if there is a potentially fraudulent payment, Cash App cancels it to stop charging you and during this situation, your funds will be immediately credited to your Cash App balance or linked bank account.

What is cash flipping on Cash App?

The scammer usually responds to such messages by asking the victim to send $10 to $1,000 through Cash App. The victim sends the money, believing that it will be invested in the stock market or in some other way so that it can be multiplied in a matter of days.

Which bank has the routing number 041215663?

The official CaspApp routing number 041215663 is for Sutton Bank.

Can I use Cash App without a bank account?

Yes, users can enjoy Cash App without a linked bank account, which is good news for those that do not have a bank account or would rather not link it to a third-party app. Because of this facility, users can send and receive money to and from your customers using the app alone.

Do you need a bank for Cash App?

Developed by Square, Cash App is another way to do transactions without a bank account. The peer-to-peer payment app is available for download for both iOS and Android mobile devices. You can use the app to send and receive money.

Why you shouldn’t use Venmo?

Venmo Prohibits It

Venmo may NOT otherwise be used to receive business, commercial or merchant transactions, meaning you CANNOT use Venmo to accept payment from (or send payment to) another user for a good or service, unless explicitly authorized by Venmo.

Does Zelle charge a fee?

Zelle® doesn’t charge a fee to send or receive money. We recommend confirming with your bank or credit union that there are no additional fees. Was this helpful?