Is being a dasher worth it?

The reality is that DoorDash is an effective side hustle, and again, DoorDash states the average hourly pay is $23 per hour. So, if you can get lucky with tips and peak pay, I think it’s possible to sometimes make $20 to $30 per hour with this side hustle.

Then, Can you live off DoorDash?

Income Goals

Living off DoorDash is likely possible if you live in a low cost of living area and don’t have any dependents. But, your income goals also influence if this is the right decision. For example, if you want to grow your wealth, you probably want to aim for a decent job with a good salary.

Who pays more DoorDash or Grubhub?

Grubhub for driver pay, DoorDash edges ahead. Not only is its national average $23/hour, but they also offer promotions to boost your pay.

Does DoorDash pay daily?

Dasher earnings are sent daily. Reward categories and amounts subject to change without notice. Cash back rewards are earned for select purchases and become available as those purchases settle.

Do you have to pay for your own gas with DoorDash?

DoorDash does not pay for gas. The driver is responsible for their own gas and any other costs associated with the vehicle and vehicle maintenance. Anyone who works for DoorDash is considered an independent contractor and is not entitled to any employer benefits.

How many hours a day can you DoorDash?

You’ll need to take an uninterrupted 6-hour break if you dash more than 12 hours within a 24-hour period. This requirement is for your safety and the safety of others. Dashers who dashed more than 12 hours in a 24-hour period at least once in the last 7 days may receive an email as well.

Do I have to pay taxes on DoorDash earnings?

Yes, you will have to pay taxes just like everyone else. If you made more than $600 working for DoorDash in 2020, you have to pay taxes. This isn’t exclusive to only DoorDash employees, either. If you took on some side jobs to make up for lost income, that money you made will be taxed.

Can I quit DoorDash anytime?

Can You Quit DoorDash Anytime? You can stop working with DoorDash at basically any time. If you want to delete your Dasher account, there’s a phone number you can contact about account questions. Doordash support will be sad to see you go, but will still walk you through all the steps you need to do.

Do you pay taxes on DoorDash income?

Yes, you will have to pay taxes just like everyone else. If you made more than $600 working for DoorDash in 2020, you have to pay taxes. This isn’t exclusive to only DoorDash employees, either. If you took on some side jobs to make up for lost income, that money you made will be taxed.

What delivery service pays the most?

10 best paying food delivery services

- Instacart. Salary: the typical Instacart delivery driver earns $29 per hour1 and about $25,165 per year6.

- Shipt.

- Uber Eats.

- Amazon Flex.

- 5 DoorDash.

- Postmates.

- Caviar.

- Grubhub.

Does DoorDash hold your first paycheck?

No. DoorDash does not hold your first paycheck. Instead, they deposit it into your bank account directly.

Who pays more uber eats or DoorDash?

According to ZipRecruiter, Uber Eats drivers earn an average of $41,175 per year compared to DoorDash drivers’ $36,565. Whereas the 25th percentile for both services earn $27,000, the 75th percentile earn $44,500 and $41,500 with Uber Eats and DoorDash, respectively.

How much does DoorDash pay without tips?

DoorDash pays more than $1 per delivery when the customer doesn’t leave a big enough tip to meet the guaranteed minimum it sets. If that minimum is $10 and you tip $5, then DoorDash kicks in the $1 base plus an additional $4. If the minimum is $10 and you tip $9, then DoorDash pays only the $1 base.

How does DoorDash pay food?

For some orders, you’ll need to pay for the food with your Red Card. For many others, you’ll simply grab the food and go. Your Dasher app will advise what to do: pay with Red Card or pick up items without payment.

Can you write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

Does DoorDash take out your taxes?

Here’s the important information we’ll talk about in this overview. No taxes are taken out of your Doordash paycheck. You will file your own taxes on Doordash (and other independent contractor work) income as a business owner. You’re taxed based on profit, not on the money you get from Doordash.

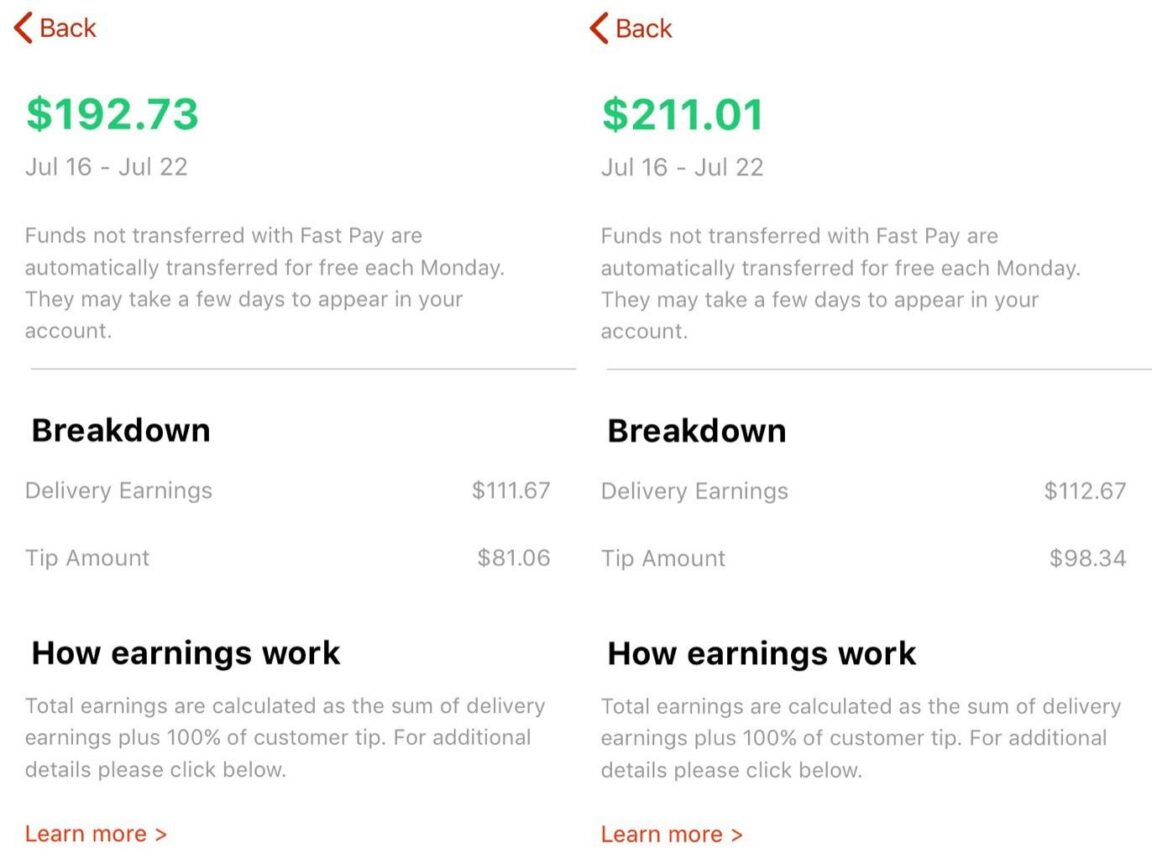

How do DoorDash drivers get paid?

Drivers delivering with DoorDash are paid weekly via a secured direct deposit to their personal bank account — or via no-fee daily deposits with DasherDirect (U.S. Only). Dashers in the U.S. can withdraw their earnings once daily with Fast Pay ($1.99 per transfer).

Does DoorDash pay daily?

Fast Pay gives Dashers in the United States the ability to cash out their earnings daily for a small fee of $1.99. This means Dashers can receive their earnings on demand through DoorDash, rather than waiting for their weekly direct deposit.

What happens when you hit 100 delivery DoorDash?

What will disqualify you from DoorDash?

These include but are not limited to DUI, driving with a suspended or expired license, and failing to stop and report an accident. Certain violent crimes will also disqualify you from driving for DoorDash. DoorDash also requires that its drivers do not have more than three “incidents” in the last three years.

Can I write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

Can you write off car payments for DoorDash?

Careful—you can’t deduct both mileage and gas at the same time! The standard mileage deduction (56 cents per mile in 2021 and 58.5 cents per mile in 2022) is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation.

What if I made less than 600 with DoorDash?

Do I have to pay taxes if I made less than $600 with Doordash? Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes.

What are the shifts for DoorDash?

11:00am – 2:00pm lunch. 5:30pm – 9:00pm dinner rush.

Does DoorDash require a schedule?

Most DoorDash markets have a system that allows Dashers to schedule hours or drop in without a schedule when order volume is high enough. The ‘Dash Now’ option allows you to go online without a schedule.

How do you end a DoorDash shift?

Tap on the Scheduled tab. Scroll through the times and tap on the Dash you’d like to delete or edit. To delete, tap on Delete in the top right corner. To edit the start or end time, tap on the time, select your new time, click Done and then Save Dash.