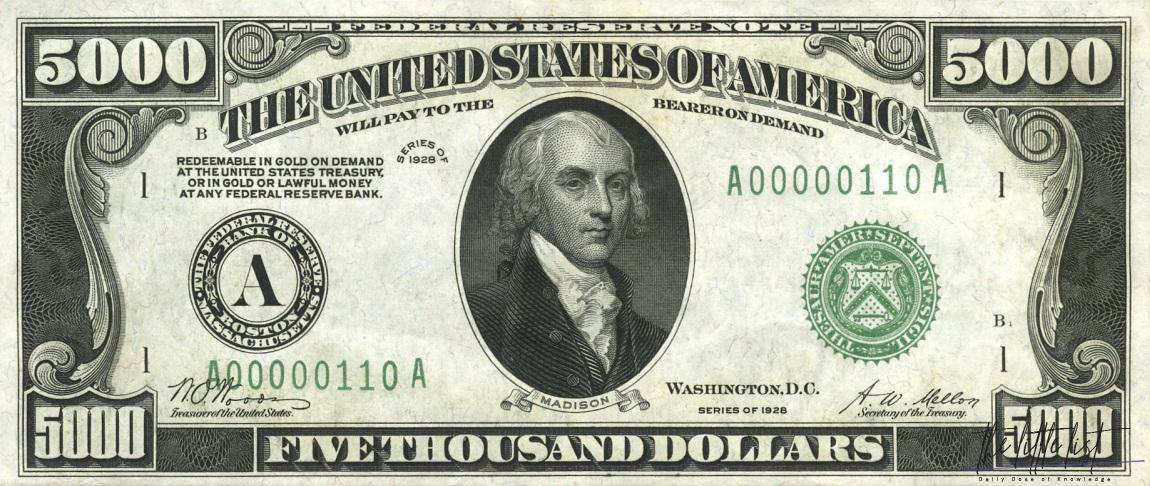

Is 5000 dollars a lot of money?

The average American spends $5,000 a year on gas. $5,000 is not a lot of money and saving it is not going to change your life. If you aren’t making at least $100,000 a year, you need to be investing in yourself so that you can have the ability to increase your income. Cardone University is $4995.

Then, Is 5k a lot of money?

To answer this question quickly, yes, $5000 is a lot of money, but it also isn’t in a lot of circumstances. Yes, it could be a lot of money for a 16-year-old, but it isn’t a lot for a 30-year-old who needs to pay for rent, health insurance, utilities, and more.

How can I make $5000 a month from home?

How to Make $5,000 a Month From Home (or ANYWHERE)

- Freelance your skills.

- Drop servicing.

- Internet scoping.

- Blogging.

- Virtual assistant.

- Amazon.

- Investing.

- Photography.

How much is $5000 a week a year?

If you make $5,000 per week, your Yearly salary would be $260,000. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 40 hours a week. How much tax do I pay if I make $5,000 per week?

How much money should you have saved at 21?

By age 21, you should try to start saving 20% of your income per the 50-30-20 rule.

What should I do with 5000 savings?

- Here are the best ways to invest $5,000.

- Invest in yourself first.

- Invest like Warren Buffett.

- Invest in high-quality dividend stocks.

- Fund a 529 plan for your child or a relative’s education.

- Fund an IRA or 401(k).

- Invest in a low- or minimum-volatility ETF.

- Fund a health savings account.

What is a good emergency fund?

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months’ worth of expenses.

How can I make 10k in a week?

And best of all, they’re all ways to make 10000 in a week from home!

- Start a blog. Blogging is not a get-rich-quick scheme.

- Publish ebooks.

- Sell online courses.

- Offer freelance services.

- Become a virtual assistant.

- Get paid to proofread.

What is 5000 a month hourly?

If you make $5,000 per month, your hourly salary would be $30.77. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 37.5 hours a week.

How can I make 20k fast?

How To Make $20k Fast

- Online Freelancing. One realistic way you can get $20k fast is to sell your skills online as a freelancer.

- Job Hop. Another idea to earn $20,000 fast is to job hop.

- Affiliate Marketing.

- Food Delivery Gigs.

- Borrow The Money.

- Rent Out Assets.

- Sell Assets You Own.

- Start An Ecommerce Business.

How much is $80000 a year per hour?

If you make $80,000 per year, your hourly salary would be $41.03. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 37.5 hours a week.

Is a 5000 dollar raise good?

The best big win for increasing your income is asking for a raise. A one-time salary increase of $5,000 — properly invested — adds up to over $1,300,000 by the time you retire. If you don’t believe me, just check out this salary calculator to see the difference that one-time pay increase makes over your career.

What’s 50000 a year hourly?

$50,000 per year is approximately $24.51 per hour, but it’s not as simple as it may seem to convert annual salary to hourly pay.

Is 10k a lot to have saved?

For some people, $10,000 could be considered a lot to have saved. Since most experts recommend maintaining 3 to 6 months of emergency savings, if your monthly living expenses sit somewhere between $1,667 and $3,334, then $10,000 should be enough (or more than enough) to cover you.

Where should I be financially at 25?

By age 25, you should have saved at least 0.5X your annual expenses. The more the better. In other words, if you spend $50,000 a year, you should have about $25,000 in savings. If you spend $100,000 a year, you should have at least $50,000 in savings.

How can I get rich in my 20s?

How To Build Wealth In Your 20s In 8 Steps!

- Create a budget.

- Contribute to your retirement fund.

- Focus on increasing your income.

- Cut back on your living expenses.

- Find a financial mentor.

- Pay off your debts.

- Focus on improving yourself.

- Stay passionate and driven.

What kind of business can I start with 5k?

If you need a little more help brainstorming, here are six businesses you can start for under $5,000.

- Tutoring or Online Courses.

- Make a product and sell it online.

- Open a consulting business.

- Create an app or game.

- Become a real estate mogul.

- Virtual Assistant.

How can I double my money?

Below are five possible ways to double your money, ranging from the low risk to the highly speculative.

- Get a 401(k) match. Talk about the easiest money you’ve ever made!

- Invest in an S&P 500 index fund.

- Buy a home.

- Trade cryptocurrency.

- Trade options.

- How soon can you double your money?

- Bottom line.

How do you invest a 5k in real estate?

If you’ve got $5,000 in your pocket, you’ve got more than enough to get started. These are 10 ways you can invest $5,000 in real estate right now.

- A down payment on your home.

- Rent to own.

- A partial down payment on a rental property.

- Rent your extra space.

- Roofstock.

- Wholesaling.

- Partner up.

What is the 50 30 20 budget rule?

Senator Elizabeth Warren popularized the so-called “50/20/30 budget rule” (sometimes labeled “50-30-20”) in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Is 10k a good emergency fund?

It’s all about your personal expenses

Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you’re comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

What can I do with cash right now?

Here are a few of the best short-term investments to consider that still offer you some return.

- High-yield savings accounts.

- Short-term corporate bond funds.

- Money market accounts.

- Cash management accounts.

- Short-term U.S. government bond funds.

- No-penalty certificates of deposit.

- Treasurys.

- Money market mutual funds.

How can I make a 50k fast?

Table of Contents

- Start Driving: Uber and Lyft.

- Take Photos on Your Phone: Snapwire.

- Work-From-Home Jobs: Amazon.

- Wrap Your Car for Cash: Wrapify.

- Perform Odd Jobs: TaskRabbit.

- Sell Stuff Online: Craigslist.

- Teach Others: Chegg Tutors.

How can I make $1000 a day?

How can you make an extra $1,000 a day fast?

- Deliver food with DoorDash.

- Dog sit and dog walk with Rover.

- Do projects on HomeAdvisor.

- Resell on eBay.

- Sell your own products on Etsy.

- Start freelance writing for blogs.

- Create an online course.

- Build a podcast following.

How can I get free money?

6 Ways to Get Free Money From the Government

- Free money from the government.

- Get help with utility bills.

- Find money for child care.

- Recover unclaimed money.

- Get down payment assistance.

- Find tax credits for health insurance.

- Apply for college grants.

- Watch out for scams.