How does PayPal friends and family work?

When you send or request money through your personal PayPal account, you can choose whether it’s a “Friends and Family” payment or a “Goods and Services” payment. Friends and Family payments are often used to pay back a friend, deliver money to family members abroad or send digital gift cards.

Then, What is the difference between PayPal and PayPal friends and family?

The main difference between PayPal business and PayPal friends and family is that PayPal business is created for merchants and sellers to carry out transactions for their commercial purposes while PayPal friends and family is created for individuals to send, receive and transfer funds and gifts between friends, family, …

Is it safe to use PayPal friends and family?

Is Sending Friends And Family Paypal Safe? PayPal Buyer Protection does not apply to money transfers between friends or family, according to a PayPal spokesperson. It is a good idea to refuse to pay friends and family when you are offered goods or services.

Does friends and family PayPal have a fee?

You can send money to friends and family via PayPal or linked bank accounts for free. You will be charged two dollars for sending to friends and family using a credit card, debit card, or PayPal credit card. The fee for this method is 9% of the amount sent, plus a flat fee of $0 per transaction.

How do I avoid PayPal fees friends and family?

You have two options: either ask them to pay directly and select the “Family and Friends” option, or you can send them a separate invoice via another payment service. There’s no payment protection for payments made through the “Family and Friends” option.

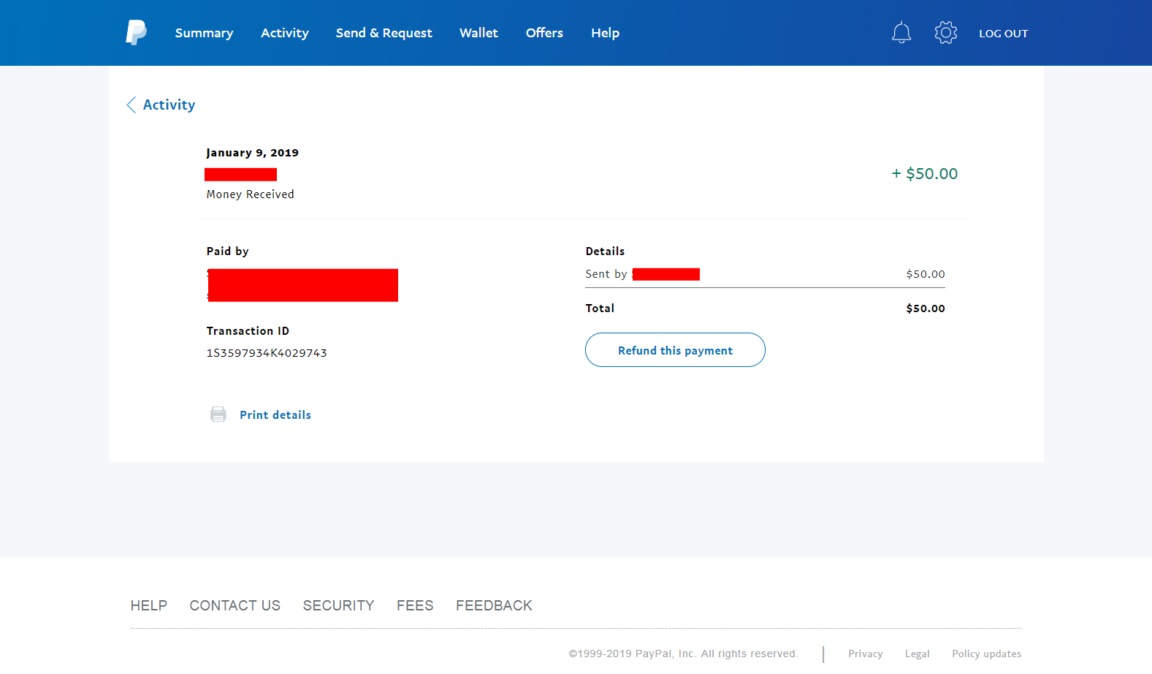

How do I know if money was sent to friends and family?

The best way to tell how money was sent is to click on the transaction and check the fees. If you were charged no fees ($0.00) then it was sent via Gift/Family and Friends. If the money you were sent does have fees taken out then it was NOT sent as a Gift/Family and Friends but rather as Goods and Services.

Does PayPal charge a fee to send money to a friend?

Fees: Sending money domestically to friends and family via a PayPal balance or linked bank account is free. Sending to friends and family, also domestically, via a credit card, debit card or PayPal credit is subject to a charge of 2.9% of the amount sent through this method, plus a fixed fee of $0.30.

Does PayPal send 1099 for friends and family?

The answer is no. As per IRS and PayPal norms, Form 1099-K will be issued if you exceed both the following thresholds in a calendar year: Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and. Over 200 separate payments for goods or services in the same calendar year.

Is sending money to friends on PayPal free?

PayPal is a secure, free way to send or receive money quickly. To send money on PayPal, both people need (free) PayPal accounts. Once you have an account, it’s just a matter of using the “Send & Request” feature on the site or app.

Why is PayPal charging me a fee for friends and family?

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money. If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Why is PayPal charging me to send money to a friend?

It is necessary for a company to generate some form of revenue from its services in order to stay in business. PayPal charges a fee for most transactions that are processed through its system in order to accomplish this. The money is usually charged to the recipient or company.

Does PayPal friends and family show address?

Does Paypal Show Your Address When You Send Money To A Friend? If you send money to a seller for an item, he or she will know your name, address, and email address. Your item will be shipped with this information.

How do I avoid PayPal fees when sending money?

Another way you can avoid fees on PayPal is by signing up for its cash card. This will allow you to use your PayPal balance anywhere Mastercard is accepted; it acts similar to a debit card. There are no monthly fees, credit checks, transaction fees, and minimum required balances.

How do I avoid PayPal fees?

8 Easy Ways to Decrease or Avoid PayPal Fees

- Opt to Be Paid Less Often.

- Change How You Withdraw Your Money From PayPal.

- Use Accounting Software to Lower PayPal Fees.

- Ask to Be Paid as a Friend or Family.

- Factor PayPal Fees into Your Payment Equation.

- Accept Other Forms of Payment.

- Use a PayPal Alternative.

How much can you make on PayPal without paying taxes 2021?

Venmo, PayPal, Cash App must report $600+ in business transactions to IRS. Starting Jan. 1, mobile money apps like Venmo, PayPal and Cash App must report annual commercial transactions of $600 or more to the Internal Revenue Service.

Do I have to claim PayPal income on taxes?

Any income you receive through PayPal, whether or not it’s reported on form 1099, must be included on your tax return. If you file as a sole practitioner, income will need to be reported on Schedule C.

How much can you make on PayPal without paying taxes?

PayPal is required to report gross payments received for sellers who receive over $20,000 in gross payment volume AND over 200 separate payments in a calendar year.

How much is the PayPal fee for $100?

PayPal’s payment processing rates range from 1.9% to 3.5% of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. The exact amount you pay depends on which PayPal product you use. This might not seem like a large amount, but a $100 transaction will cost you between $2 and $3.99.

How do I avoid receiving PayPal fees?

How Do I Receive Money On Paypal Without Fees? You do not have to pay fees if you use your PayPal balance or linked bank account as your funding source to send money to friends and family. The only thing you need to do is select the “Send Money” tab and then choose “Personal”.

How do I accept money from a friend on PayPal?

How to Receive Money on PayPal from a Friend

- Log into your PayPal account.

- Click the “Send & Request” tab at the top of the page.

- In the “Names or emails” field, enter your friend’s email address and click “Next.”

- Enter the amount you’re requesting.

- Click “Request a Payment” and that’s it.

Which is better venmo or PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice. Sign up for Venmo now.

Who pays the fee on PayPal?

When completing a transaction through PayPal, the seller must pay a PayPal fee. The buyer isn’t forced to pay any fee. The fee the seller pays is calculated for each transaction and is represented as a percentage of the total transaction plus 30 cents.

Does PayPal 2021 get a 1099?

Under a provision in the American Rescue Plan Act of 2021, also known as the COVID-19 Stimulus Package, individuals and businesses on certain online platforms who process more than $600 will now receive a 1099-K regardless of how many individual transactions or payments are processed during the calendar year.

Why did I receive a 1099-K from PayPal?

Why did I receive a Form 1099-K? You received a Form 1099-K because a third party payment processor paid $600 or more to you in the previous calendar year.

Will I get a w2 if I earned less than $600?

Workers who receive a W-2 from a company with less than $600 in wages are still responsible for reporting it as there is no W-2 minimum amount to file. Description:The employer is required to send you a copy – Part B and C of the W-2 – either by mail or electronically by January 31 of the subsequent tax year.

What is the limit on PayPal friends and family?

Send money to friends and family

Limits: You can transfer up to $10,000 in a PayPal transaction, or up to $60,000 if you’ve provided your bank account data or other identifying information. Timing: Transfers to and from your bank account and PayPal account can take a few days.

Will I get a 1099 from PayPal?

PayPal and Venmo will be required to provide customers with a 1099-K form if they receive $600 or more in goods and services transactions during the 2022 tax year. This means you will need to take into account the Threshold Change with your Tax Year 2022 filings.

What are the pros and cons of PayPal?

Pros & Cons of PayPal for Small Businesses

| PROS | CONS |

|---|---|

| Secure means of sending payment | Popular target for phishing and scams |

| Diverse financing options | Poor customer service |

| Extensive online and in-person payment solutions | Digital purchases aren’t protected |

| Additional merchant support features | Disputes can delay refunds |

• Dec 15, 2021