How do I avoid PayPal fees?

How to Avoid PayPal Fees

- Opt to Be Paid Less Often. …

- Change How You Withdraw Your Money From PayPal. …

- Use Accounting Software to Lower PayPal Fees. …

- Ask to Be Paid as a Friend or Family. …

- Factor PayPal Fees into Your Payment Equation. …

- Accept Other Forms of Payment. …

- Use a PayPal Alternative. …

- Include PayPal Fees as a Tax Deduction.

Subsequently, How much does it cost to send $1000 on PayPal?

Sending/Withdrawing/Transferring Money

30 for U.S. transactions. *Example: You send $1,000 to a friend and you have to use your linked debit card to cover the payment, you will pay the $1,000 + $29 (transaction fee) $. 30 fixed fee.

What are standard PayPal fees?

Standard rate for receiving domestic transactions

| Payment Type | Rate |

|---|---|

| Invoicing | 3.49% + fixed fee |

| PayPal Checkout | 3.49% + fixed fee |

| PayPal Guest Checkout | 3.49% + fixed fee |

| QR code Transactions – 10.01 USD and above | 1.90% + fixed fee |

Why PayPal fees are so high?

The reason is that PayPal charges a fee for every payment that businesses receive, so the more payments businesses receive, the more fees they would have to pay. For domestic payments, you would pay 5% + $0.05 USD per transaction with micropayments pricing versus the standard fee of 2.9% + $0.30 USD per transaction.

Why did PayPal charge me a fee for receiving money?

To stay in business, the company needs to make some form of income off of its services. To do this, PayPal charges a fee for most transactions that go through its system. And in most cases, these fees are charged to the person or company receiving the money.

What percentage does PayPal take?

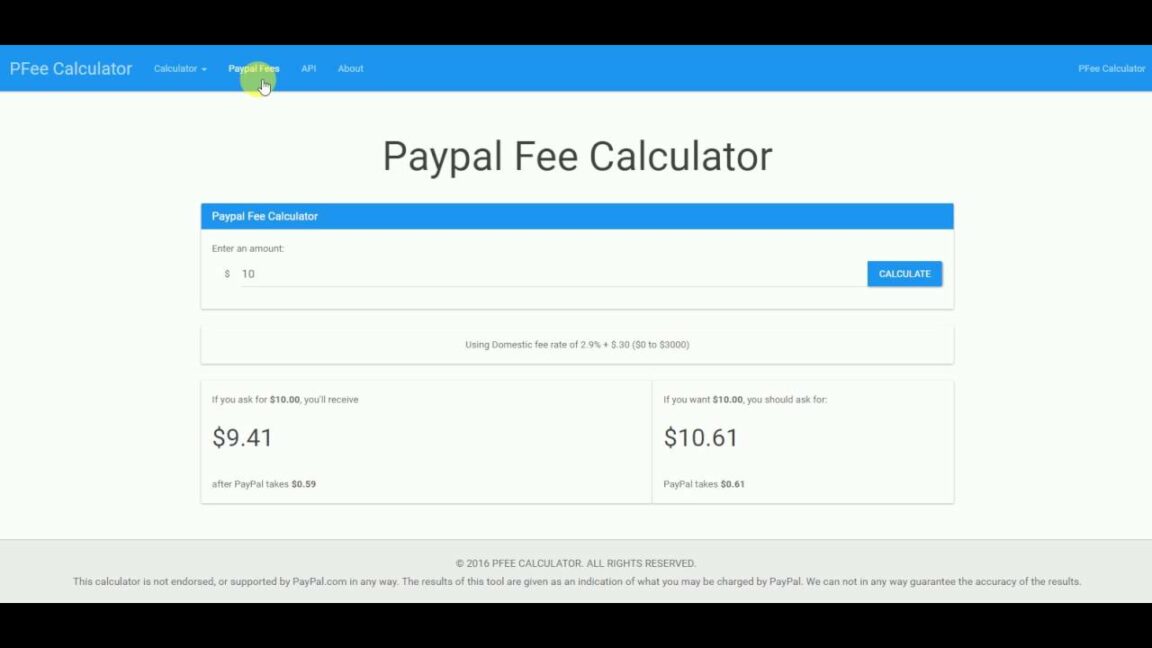

PayPal’s basic fee is 2.9% plus $0.30 USD per sale.

What Percentage Does PayPal Take?

| PayPal Transaction | PayPal Percentage |

|---|---|

| Sales within the US | 2.9% plus $0.30 USD per transaction |

Why are PayPal fees so high?

The reason is that PayPal charges a fee for every payment that businesses receive, so the more payments businesses receive, the more fees they would have to pay. For domestic payments, you would pay 5% + $0.05 USD per transaction with micropayments pricing versus the standard fee of 2.9% + $0.30 USD per transaction.

Why is PayPal charging me a fee for friends and family?

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money. If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Why is there a $4.99 fee PayPal?

PayPal offers two different payment methods for international money transfers and each has its own fee structure. When sending money directly to another PayPal account, PayPal charges 5% of the transaction with a minimum fee of $0.99 and a maximum fee of $4.99. This assumes the transfer is funded by a PayPal balance.

Who pays PayPal fees buyer or seller?

When completing a transaction through PayPal, the seller must pay a PayPal fee. The buyer isn’t forced to pay any fee. The fee the seller pays is calculated for each transaction and is represented as a percentage of the total transaction plus 30 cents.

Which is better Venmo or PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice. Sign up for Venmo now.

What is the best alternative to PayPal?

Best PayPal Alternatives

- Google Pay.

- WePay.

- 2CheckOut.

- Authorize.Net.

- Skrill.

- Intuit.

- ProPay.

- Dwolla.

What are the pros and cons of PayPal?

Pros & Cons of PayPal for Small Businesses

| PROS | CONS |

|---|---|

| Secure means of sending payment | Popular target for phishing and scams |

| Diverse financing options | Poor customer service |

| Extensive online and in-person payment solutions | Digital purchases aren’t protected |

| Additional merchant support features | Disputes can delay refunds |

• Dec 15, 2021

Is receiving money through PayPal free?

When it comes to basic transactions, like sending or receiving money between PayPal accounts within the US, the payment transfer platform is free.

Does PayPal charge me to receive money?

There is no fee for opening a PayPal account. The cost for each sale or payment received is 2.9% plus $0.30 USD (volume sellers may get a discount) for sales within the US. There is no fee to transfer funds to your registered checking account; it costs $1.50 to have a check issued; transfers via debit card cost $. 25.

What are PayPal fees on 2021?

New PayPal Fees

2, PayPal will increase its merchant fees from 2.9% + $0.30 per transaction to a fixed fee of 3.49% + $0.49 for all U.S.-based online transactions. Other fees, such as QR code transactions, will not be affected or will change at a different rate.

What are PayPal fees in 2021?

To sum up, compared with the current rate which is 2.9% plus $0.30, online transaction fees will rise to 3.49% plus $0.49.

Do you get charged for receiving money on PayPal?

Buying and sending money can be easy, fast, and secure when using PayPal.

Fixed fee for donations (based on currency received)

| Currency | Fee |

|---|---|

| UK pounds sterling | GBP 0.30 |

| US dollar | USD 0.30 |

How can I receive money without fees?

Venmo is available for Android and iOS. Verified accounts can send up to $4,999.99 per week. Venmo doesn’t charge a fee for sending or receiving money via balance, bank or debit card.

Will PayPal charge me to send money to a friend?

Friends and Family payments can be made to anyone in the U.S. for free (from your bank account or PayPal). If you are sending money internationally, you may be charged a transaction fee equal to 5% of the send amount (up to $4.99 USD).

Does PayPal charge a fee to send money to a friend?

Fees: Sending money domestically to friends and family via a PayPal balance or linked bank account is free. Sending to friends and family, also domestically, via a credit card, debit card or PayPal credit is subject to a charge of 2.9% of the amount sent through this method, plus a fixed fee of $0.30.

How much is the PayPal fee for friends and family?

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money. If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Can I ask buyer to pay PayPal fees?

It’s a violation of the Paypal terms to ask the buyer to pay the fees. You CAN offer a discount for check or cash, but you probably prefer the convenience of immediate funds, and that’s the service you’re paying for. No shops do it, and that’s what your used price is compared to. It’s just the cost of selling.

Can I charge my customer the PayPal fee?

The key is that “PayPal clients” cannot be charged a higher fee than “non-PayPal clients.” Here is a handy tool to help you reach the bottom line that you want, after PayPal fees. Remember, you cannot charge a surcharge to the PayPal clients but you can use this to set fees, across the board, for your small biz.

Can a seller ask a buyer to cover PayPal fees?

Under PayPal’s tos, it’s actually illegal for a seller to ask a buyer to pay the paypal fee, or for this matter any other surcharge. Of course this doesnt mean shipping but it does mean for everyone asking people to pay PayPal fees, that if someone reports them they could loose their paypal account.