How can I save 10000 in 12 months?

6 Ways how to save $10,000 in a year

- Save on bills. …

- Cut back on eating out. …

- Reduce your entertainment costs. …

- Finding ways to earn more is how to save $10,000 in a year faster. …

- Find easy ways to automate your savings. …

- Try a spending fast.

Then, How can I save $10000 in 6 months?

Here are five steps to saving as much as $10,000 in six months, income permitting.

- Set Goals and Visualize Yourself Achieving Them.

- Consider a Spending Freeze.

- Create a Budget.

- Make Savings Deposits Automatic.

- Consider Ways To Make More Money.

Is saving 10k a year good?

Saving $10,000 is a wonderful accomplishment but it’s critical to put that hard-earned cash to good use. With $10,000 in savings, there are many things you could do, but here are five safe and wise ways to allocate your cash.

How does the 100 envelope Challenge work?

What is this? Each day you draw an envelope and whatever number you draw, you place that amount of cash inside and you do this for 100 days until the envelopes are filled. For example, if on day one you draw the number 67 you would deposit $67 into that envelope and seal it.

How can I save 10k in 4 months?

How to save $10,000 in 4 months

- PHOTOGRAPH: 123rf.com.

- SAVE $1,800: DETERMINE A BUDGET. Know how much you are spending every month.

- SET UP A SYSTEM FOR SAVING.

- CHECK YOUR EXPENSES.

- SAVE $520- SKIP THE TAXIS.

- SAVE $92- CUT BACK ON GOURMET COFFEE.

- SAVE $226- PACK YOUR LUNCH.

- SAVE $250- BUY YOUR OWN DRINKS.

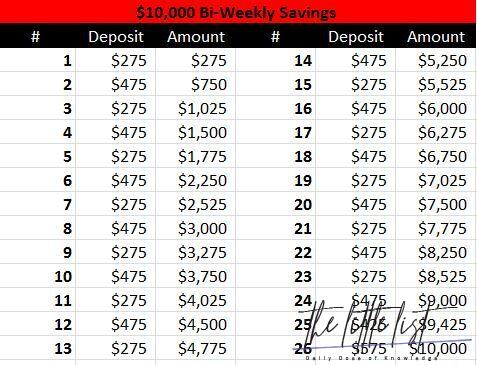

How can I save $10000 in 26 weeks?

26 Week Money Saving Challenge – Saving $10,000 in 26 Weeks

Doubling your savings from the previous challenge- $10,000 in a year. What is this? In this challenge you will be saving $375-$400 every other week (or each paycheck).

How do you flip a 10k fast?

How To Turn 10k Into 20k

- Flip Stuff For Money. One of the more entreprenurial ways to flip 10k into 20k is to buy and resell stuff for profit.

- Invest In Real Estate.

- Invest In Cryptocurrency.

- Start An Online Business.

- Start A Side Hustle.

- Invest In Stocks.

- Invest In Debt.

How much should the average 25 year old have in savings?

By age 25, you should have saved about $20,000. Looking at data from the Bureau of Labor Statistics (BLS) for the first quarter of 2021, the median salaries for full-time workers were as follows: $628 per week, or $32,656 each year for workers ages 20 to 24. $901 per week, or $46,852 per year for workers ages 25 to 34.

How much savings should I have at 35?

It said the ideal amount to save by 35 is 2x your income at 35. For instance, if you are earning Rs 10 lakh at 35, your savings by 35 should be at least Rs 20 lakh.

How can I save $5000 in 3 months with 100 envelopes?

How To Get Started Saving $5,000 in 100 Days

- Get 100 empty envelopes.

- Write a number on each envelope.

- Store your envelopes in a container.

- Shuffle the envelopes in random order.

- Pick an envelope at random each day.

- Insert the day’s money amount in the envelope.

- Put the filled envelope aside.

How can I save $5000 in 3 months?

How to Save $5000 in 3 Months

- Step 1 – Draw up a plan to save 5k in 3 months.

- Step 2 – Keep your savings separate.

- Step 3 – Save $5,000 in three months by shaving expenses.

- Step 4 – Get that money.

- Step 5 – Set Reminders.

How can I save $1000 in 3 months?

Make a plan

If you want to save $1,000 in a month, that is $33 a day or about $250 a week. If you want to save your $1,000 in 3 months, you’d need to be saving $11 a day or about $83 a week. If you wanted to reach your savings goal in 6 months, you could pull it off by saving about $5.50 a day or $42 a week.

What is the 30 day rule?

With the 30 day savings rule, you defer all non-essential purchases and impulse buys for 30 days. Instead of spending your money on something you might not need, you’re going to take 30 days to think about it. At the end of this 30 day period, if you still want to make that purchase, feel free to go for it.

What is the 10k money Challenge?

HealthyWage is a company supported by the Government to incentivize people to lose weight by putting their own money at risk with the potential to earn up to $10,000. It’s the ultimate losing weight challenge.

How can I save 15k in a year?

7 Tips To Save $15,000 For Travel in Just One Year

- Write Down Your Budget.

- Automatic Transfer.

- Use A Money App.

- Put Your Spending On Credit Cards.

- Save Your Pennies.

- Lock In Your Savings.

- Don’t Go Out!

How can I save 5k in 3 months?

How to Save $5000 in 3 Months

- Step 1 – Draw up a plan to save 5k in 3 months.

- Step 2 – Keep your savings separate.

- Step 3 – Save $5,000 in three months by shaving expenses.

- Step 4 – Get that money.

- Step 5 – Set Reminders.

How do I turn 10K into 100K a year?

How To Turn 10K Into 100K

- Start An Online Business.

- Start A Service-Based Business.

- Invest In Real Estate.

- Make Money With Retail Arbitrage.

- Invest In Stocks and ETFs.

- Start A Blog & YouTube Channel.

- Start An Etsy Store.

- Flip Stuff To Make Money.

How can I get rich with 10K?

Below are some ideas on how to make the most of your $10k.

- Invest in Stocks.

- Invest in Mutual Funds or Exchange-Traded Funds (ETFs)

- Invest in Bonds.

- Use a Robo-Advisor for Automatic Investing.

- Invest in Real Estate.

- Start Your Own Business.

- Invest in Peer-to-Peer Lending.

- Open a CD Account.

Is 10K a lot of money?

Put simply, $10K is not typically considered a lot of money. In fact, for many Americans, that isn’t even enough to cover their living expenses for 3 months. Rather, according to our research, the value at which most people consider to be “a lot of money” sits between $500K and $2.5 Million.

Where should I be financially at 30?

Created with sketchtool. By 30, you should have a decent chunk of change saved for your future self, experts say — in fact, ideally your account would look like a year’s worth of salary, according to Boston-based investment firm Fidelity Investments, so if you make $50,000 a year, you’d have $50,000 saved already.

How much should a 27 year old have saved?

Fast answer: A general rule of thumb is to have one times your annual income saved by age 30, three times by 40, and so on.

What should net worth be at 30?

Net Worth at Age 30

By age 30 your goal is to have an amount equal to half your salary stored in your retirement account. If you’re making $60,000 in your 20s, strive for a $30,000 net worth by age 30.

What should net worth be at 40?

Net Worth at Age 40

By age 40, your goal is to have a net worth of two times your annual salary. So, if your salary edges up to $80,000 in your 30s, then by age 40 you should strive for a net worth of $160,000. Additionally, it’s not just contributing to retirement that helps you build your net worth.

Is it too late to save for retirement at 35?

Key Takeaways. It’s never too late to start saving money for your retirement. Starting at age 35 means you have 30 years to save for retirement, which will have a substantial compounding effect, particularly in tax-sheltered retirement vehicles.

How much does the average 30 year old have saved?

How much money has the average 30-year-old saved? If you actually have $47,000 saved at age 30, congratulations! You’re way ahead of your peers. According to the Federal Reserve’s 2019 Survey of Consumer Finances, the median retirement account balance for people younger than 35 is $13,000.