Does DoorDash get taxed?

Yes, you will have to pay taxes just like everyone else. If you made more than $600 working for DoorDash in 2020, you have to pay taxes. This isn’t exclusive to only DoorDash employees, either. If you took on some side jobs to make up for lost income, that money you made will be taxed.

Then, How long does it take to get your DoorDash money?

Through Direct Deposit, Dashers get paid on a weekly basis for all deliveries completed between Monday – Sunday of the previous week (ending Sunday at midnight). Payments are transferred at that time directly to your bank account with a 2-3 day processing period and usually appear by Wednesday night.

Can I write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

Is being a dasher worth it?

The reality is that DoorDash is an effective side hustle, and again, DoorDash states the average hourly pay is $23 per hour. So, if you can get lucky with tips and peak pay, I think it’s possible to sometimes make $20 to $30 per hour with this side hustle.

Do you have to pay for your own gas with DoorDash?

DoorDash does not pay for gas. The driver is responsible for their own gas and any other costs associated with the vehicle and vehicle maintenance. Anyone who works for DoorDash is considered an independent contractor and is not entitled to any employer benefits.

Can you make 200 a day with DoorDash?

If you plan on working 7 days per week, and assuming an average of 30 days per month, you will need to make $133 per day to reach that goal. If you plan on working just Monday through Friday, that raises your daily number to $200 per day.

Do you have to wait 7 days for DasherDirect?

Dashers will have to wait for 7 days after adding the bank account details to use Fast Pay. There is no exception to this. The 7-day block cannot be unblocked.

Can you be fired from DoorDash?

The Dasher Deactivation Policy may be found here. There are minimum Consumer Ratings and Completion Rates required to remain active on the DoorDash platform. Dashers with a Consumer Rating below 4.2 or a Completion Rate below 80% may be subject to deactivation once they have accepted at least 20 orders.

How much of my DoorDash money should I save for taxes?

Generally, you should set aside 30-40% of your income to cover both federal and state taxes. Whether you file your taxes quarterly or annually, you need to set aside a portion of your income for your taxes.

What happens if you didn’t track your mileage DoorDash?

All you can do on Doordash is go into your earnings tab. You’ll need to take screenshots to get that documentation. Unfortunately, Doordash only provides about six months worth of records. They put a link on their website where you can request a history.

What if I made less than 600 with DoorDash?

Do I have to pay taxes if I made less than $600 with Doordash? Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes.

What will disqualify you from DoorDash?

These include but are not limited to DUI, driving with a suspended or expired license, and failing to stop and report an accident. Certain violent crimes will also disqualify you from driving for DoorDash. DoorDash also requires that its drivers do not have more than three “incidents” in the last three years.

Does DoorDash give you a W2?

No, DoorDash does not send its delivery drivers a W2 form. Rather, DoorDash provides its DoorDashers with a 1099-NEC form, but only if they earned over $600 during the year. Further, DoorDash partners with a company called Stripe to provide a 1099-NEC form.

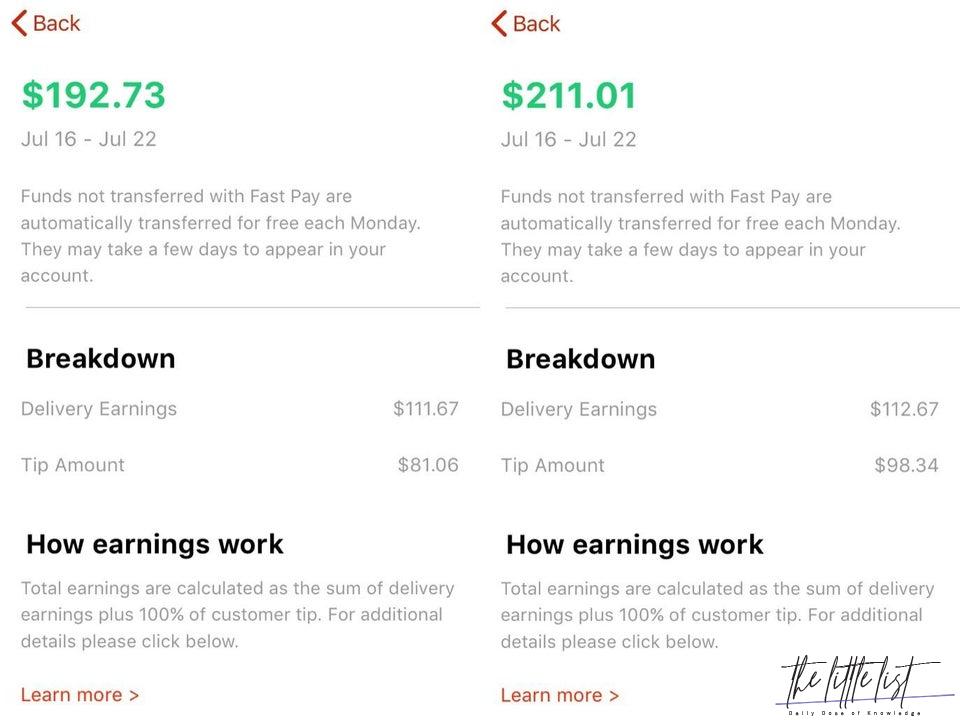

How does DoorDash tipping work?

100% of tips are passed onto the Dasher. You will be invoiced at the end of the month for the delivery tips that the customers left for each order or if you are paying by credit card, you will be charged for the tip at the time the order is submitted in the Drive Portal.

Is DoorDash worth after gas and taxes?

Plus, as an independent contractor, you can potentially claim some operational expenses like your mileage to help you out on your tax return. In this sense, DoorDash is worth it after taxes, but it’s important to keep track of your income and expenses so you can accurately report your earnings.

How many hours can you DoorDash in one day?

You’ll need to take an uninterrupted 6-hour break if you dash more than 12 hours within a 24-hour period. This requirement is for your safety and the safety of others. Dashers who dashed more than 12 hours in a 24-hour period at least once in the last 7 days may receive an email as well.

Is it worth it to be a Doordasher?

The average pay is higher than minimum wage, and some drivers have made great money from it. However, the work and pay rate is not consistent enough to act as a reliable full-time job. Instead, as a gig economy job, you may possibly earn around $20 to $30 an hour if you are lucky with peak pay and tips.

Can I use my DasherDirect card anywhere?

As a Dasher, you run your own business, so Visa’s Business platform is set up for contractors like you. You can use your DasherDirect card anywhere Visa is accepted.

Can I overdraft my DasherDirect card?

Through the DasherDirect app, Dashers can check their account balance, pay bills, transfer money, set savings goals and find no fee ATMs on the go – without worrying about overdraft fees or minimum account balance requirements.

How do I cash out on DasherDirect?

Once you’ve activated your physical DasherDirect card, your account will be set to automatic payouts. To switch your payout method to weekly direct deposits or Fast Pay (fees apply), tap the ‘Bank’ icon and on the Earnings screen in your Dasher app, then tap ‘Switch Payout Account’.

Can you quit DoorDash at any time?

Can You Quit DoorDash Anytime? You can stop working with DoorDash at basically any time. If you want to delete your Dasher account, there’s a phone number you can contact about account questions. Doordash support will be sad to see you go, but will still walk you through all the steps you need to do.

Does DoorDash have a dress code?

What is the uniform requirement at DoorDash? Sure you can, as there is no dress code, but you have to remember that you may be going up three or four levels of stairs There are no official uniform requirements.

Does DoorDash punish you for declining orders?

Can Doordash punish you for declining orders? No. Doordash is not your employer. As such, they cannot take punitive action.

Does DoorDash report to IRS?

A 1099-NEC form summarizes Dashers’ earnings as independent contractors in the US. It’s provided to you and the IRS, as well as some US states, if you earn $600 or more in 2021. If you’re a Dasher, you’ll need this form to file your taxes.

How do I track mileage for taxes?

At the start of each trip, record the odometer reading and list the purpose, starting location, ending location, and date of the trip. At the conclusion of the trip, the final odometer must be recorded and then subtracted from the initial reading to find the total mileage for the trip. 3.

Does DoorDash give Paystubs?

Unfortunately there is no paystub or employment verification from Doordash. That’s because Dashers are independent contractors and not employees. That doesn’t mean you’re out of luck. It just means you have to provide different kinds of records.