Can you only do fast pay once a day on DoorDash?

You can only cash out with Fast Pay once per day. For account protection, you will not be able to use Fast Pay for 7 calendar days after any changes are made to your debit card information. This processing period cannot be expedited by anyone on the DoorDash team.

Subsequently, How fast is Dasher fast pay?

Payments are transferred at that time directly to your bank account with a 2-3 day processing period and usually appear by Wednesday night. Fast Pay gives Dashers the ability to cash out their earnings daily for a small fee of $1.99, rather than waiting for their weekly direct deposit.

How long is fast pay on DoorDash?

1. When Do Fast Pay Earnings Appear? According to DoorDash, “transfers usually happen within minutes, but they can take up to a few business days to appear on your debit card depending on your bank’s processing time.”

How do you make $100 a day on DoorDash?

Example: If you complete a minimum of 50 deliveries within 7 days as an active Dasher, you will earn at least $500. If you earn $400, DoorDash will add $100 the day following the last day of the Guaranteed Earnings period.

How many times a day can you cash out with fast pay on DoorDash?

You can cash out your earnings up to once per day, at any time you like (even on weekends). However, do note that some banks limit the number of debit card transactions per day for security reasons. If you have a lot of other transactions in one day, then Fast Pay may not work.

Do I have to wait 7 days for fast pay?

Dashers will have to wait for 7 days after adding the bank account details to use Fast Pay. There is no exception to this. The 7-day block cannot be unblocked.

Does DoorDash take taxes out of your pay?

No taxes are taken out of your Doordash paycheck. You will file your own taxes on Doordash (and other independent contractor work) income as a business owner. You’re taxed based on profit, not on the money you get from Doordash. The best ways to use this knowledge and prepare for taxes.

Can you overdraft Dasher direct card?

Through the DasherDirect app, Dashers can check their account balance, pay bills, transfer money, set savings goals and find no fee ATMs on the go – without worrying about overdraft fees or minimum account balance requirements.

Does DoorDash pay daily?

When do I get paid? Drivers delivering with DoorDash are paid weekly via a secured direct deposit to their personal bank account — or via no-fee daily deposits with DasherDirect (U.S. Only).

Can you overdraft DasherDirect card?

Through the DasherDirect app, Dashers can check their account balance, pay bills, transfer money, set savings goals and find no fee ATMs on the go – without worrying about overdraft fees or minimum account balance requirements.

How many times can you cash out with DasherDirect?

As long as you have more than $1.99 in your DoorDash account, you can cash out using Fast Pay. You’re limited to one transfer a day, so it’s best to cash out after you complete a shift. That way, your orders are complete, you have your customer tips, and you can access all the DoorDash earnings.

Can you get paid daily with DoorDash?

Daily Payouts is a premium feature that allows you to opt-in to receive daily payouts (excluding weekends) for sales completed on the DoorDash platform 3 days in arrears. Currently, merchant payouts are issued weekly on Thursday for sales completed the previous Monday-Sunday.

Can I write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

Do I need to report DoorDash income if less than 600?

Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes. It’s only that Doordash isn’t required to send you a 1099 form if you made less than $600.

Does DoorDash track your mileage?

DoorDash doesn’t keep track of your mileage as a delivery driver, so you can’t just login to your Dasher app and get a tax-ready print out of all the mileage you drive for DoorDash.

Can I use my DasherDirect virtual card at ATM?

ATMs and withdrawals

If you allow the DasherDirect app to access your location, the DasherDirect app will find nearby free or low-fee ($2.50) Allpoint ATMs. You can just simply go to ‘Quick Services’ and click on ‘ You can also make withdrawals from any ATM that accepts VISA for $2.50 per withdrawal.

Can I use someone else’s bank account for DoorDash?

Yes, you can. I believe Doordash also has a paycard of their own for Dashers to have their earnings deposited to. You should be able to. As long as you have both the routing and account numbers to enter into the Dasher app (you can get them off the bottom of a check).

How do you use fast pay on DoorDash?

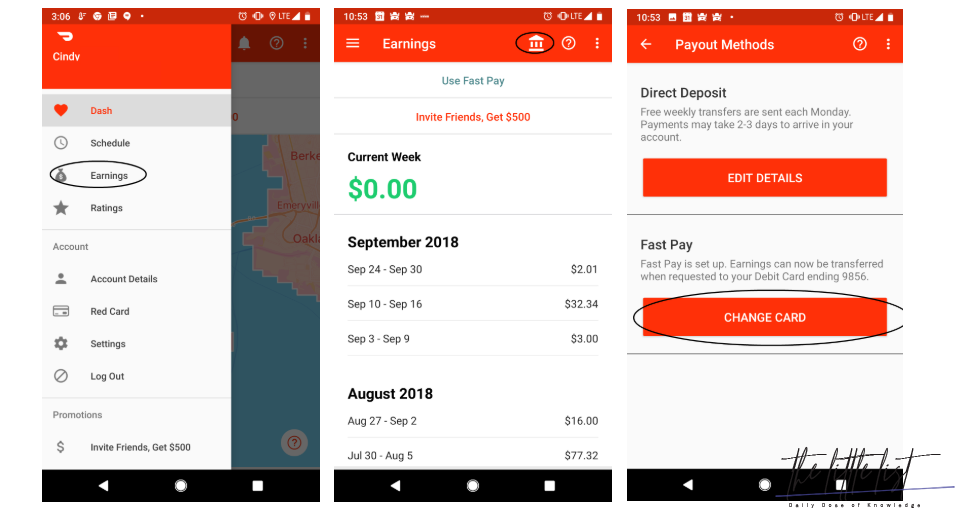

How To Use Fast Pay On Doordash?

- Open the Dasher App.

- Tap on the menu “Earnings“

- Tap on the menu “Deposits and Transfers”. Here you will find your current available balance for FastPay.

- Tap on the button ‘Transfer’. Your available earnings will be directly transferred to the debit card linked to your account.

How do I get my daily payout on DoorDash?

You can opt-in to Daily Payouts via the merchant portal. To opt-in, go to the ‘Settings’ page in your merchant portal. Within this window, you will see a button with the prompt ‘Get Daily Payouts’ towards the bottom.

How do you become a top Dasher?

What Are the Top Dasher Requirements?

- Having a customer rating of 4.7 or more.

- Having an acceptance rate of 70 percent or larger.

- Reaching a DoorDash completion rate of at least 100 deliveries over the last month.

- Completing at least 200 deliveries across the entire use of the DoorDash app.

How do I get paid after every dash?

Once your new card arrives and you activate your DasherDirect account, you’ll automatically receive payouts after every dash, at no fee, to your DasherDirect account, and you’ll no longer be able to cash out daily with Fast Pay.

Can I use DasherDirect virtual card for gas?

One of the prepaid debit card’s main perks is that you get 2% cash back on gas purchases at any gas station. Because of this, you can save a lot if you’re frequently driving. You could also use the card to send funds or pay bills. You should note that the cash back only applies to gas and nothing else.

Can I use my DasherDirect card anywhere?

As a Dasher, you run your own business, so Visa’s Business platform is set up for contractors like you. You can use your DasherDirect card anywhere Visa is accepted.

Can I use my virtual DasherDirect card for gas?

One of the prepaid debit card’s main perks is that you get 2% cash back on gas purchases at any gas station. Because of this, you can save a lot if you’re frequently driving. You could also use the card to send funds or pay bills. You should note that the cash back only applies to gas and nothing else.

Can you make a living off DoorDash?

Drivers, known as Dashers, make money delivering food with DoorDash as independent contractors. The gig takes little time to start, pays frequently, offers flexible hours and could be a great way to make money without a traditional job. But earnings can fluctuate along with demand and delivery details.

How much of my DoorDash money should I save for taxes?

Generally, you should set aside 30-40% of your income to cover both federal and state taxes. Whether you file your taxes quarterly or annually, you need to set aside a portion of your income for your taxes.

How do you become a top Dasher?

Here is what DoorDash specifies as the Top Dasher qualifications:

- Customer rating of at least 4.7.

- Acceptance rate of at least 70%

- Completion rate of at least 95%

- 100 completed deliveries during the last month.

- At least 200 lifetime deliveries completed.

Can you write-off car repairs for DoorDash?

To do so, you’ll need to add up everything you paid for your car during the year. Car insurance, gas, repair bills, inspection fees, tolls and parking fees are all deductible expenses, but there’s a catch. You can only deduct the portion of these expenses that applied to your work.