Can you live off DoorDash?

Living off DoorDash is likely possible if you live in a low cost of living area and don’t have any dependents. But, your income goals also influence if this is the right decision. For example, if you want to grow your wealth, you probably want to aim for a decent job with a good salary.

Then, Is being a DoorDash driver worth it?

The reality is that DoorDash is an effective side hustle, and again, DoorDash states the average hourly pay is $23 per hour. So, if you can get lucky with tips and peak pay, I think it’s possible to sometimes make $20 to $30 per hour with this side hustle.

Do you have to pay for your own gas with DoorDash?

DoorDash does not pay for gas. The driver is responsible for their own gas and any other costs associated with the vehicle and vehicle maintenance. Anyone who works for DoorDash is considered an independent contractor and is not entitled to any employer benefits.

How many hours a day can you DoorDash?

You’ll need to take an uninterrupted 6-hour break if you dash more than 12 hours within a 24-hour period. This requirement is for your safety and the safety of others. Dashers who dashed more than 12 hours in a 24-hour period at least once in the last 7 days may receive an email as well.

Does DoorDash take taxes out of your pay?

No taxes are taken out of your Doordash paycheck. You will file your own taxes on Doordash (and other independent contractor work) income as a business owner. You’re taxed based on profit, not on the money you get from Doordash. The best ways to use this knowledge and prepare for taxes.

Does DoorDash pay mileage?

DoorDash doesn’t pay for its delivery drivers’ mileage. This is because when you deliver for DoorDash, you’re an independent contractor, and therefore are responsible for providing your own car, its repairs, gas, mileage, etc.

Who pays more DoorDash or Grubhub?

Grubhub for driver pay, DoorDash edges ahead. Not only is its national average $23/hour, but they also offer promotions to boost your pay.

Can someone ride with you while doing DoorDash?

Your friend’s in luck—someone can ride with you while driving for DoorDash. Of the food delivery services, DoorDash is one of the more relaxed when it comes to rules. As long as you deliver your orders on time, they don’t make a fuss about how you do it.

Does DoorDash pay more with gas prices?

Dashers who qualify for both rewards could receive anywhere between $1.65 and $2.00 per gallon. The food delivery service joins the ranks of Uber and Lyft, which both announced surcharges upwards of $0.55 to riders in an attempt to make up for the rise in gas prices.

What happens when you hit 100 delivery DoorDash?

What will disqualify you from DoorDash?

These include but are not limited to DUI, driving with a suspended or expired license, and failing to stop and report an accident. Certain violent crimes will also disqualify you from driving for DoorDash. DoorDash also requires that its drivers do not have more than three “incidents” in the last three years.

Can I write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

What if I made less than 600 with DoorDash?

Do I have to pay taxes if I made less than $600 with Doordash? Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes.

What is the $15 Challenge on DoorDash?

Doordash Challenges let you earn a cash reward if you complete a set number of deliveries within a certain time period—typically within a week or weekend. Here’s an example: Complete 15 deliveries this week and get an extra $15.

Can you write off gas for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.

Does DoorDash take out your taxes?

Here’s the important information we’ll talk about in this overview. No taxes are taken out of your Doordash paycheck. You will file your own taxes on Doordash (and other independent contractor work) income as a business owner. You’re taxed based on profit, not on the money you get from Doordash.

Can I quit DoorDash anytime?

Can You Quit DoorDash Anytime? You can stop working with DoorDash at basically any time. If you want to delete your Dasher account, there’s a phone number you can contact about account questions. Doordash support will be sad to see you go, but will still walk you through all the steps you need to do.

Do you pay taxes on DoorDash income?

Yes, you will have to pay taxes just like everyone else. If you made more than $600 working for DoorDash in 2020, you have to pay taxes. This isn’t exclusive to only DoorDash employees, either. If you took on some side jobs to make up for lost income, that money you made will be taxed.

What delivery service pays the most?

10 best paying food delivery services

- Instacart. Salary: the typical Instacart delivery driver earns $29 per hour1 and about $25,165 per year6.

- Shipt.

- Uber Eats.

- Amazon Flex.

- 5 DoorDash.

- Postmates.

- Caviar.

- Grubhub.

What day are dashers paid?

They pay weekly every Monday, depending on which bank you use it could take 2-3 days for the funds to show up (so by Wednesday for most) then after 7 days and 25 deliveries you can sign up for fast pay.

What do you wear while door dashing?

There are no official uniform requirements. But “revealing” or “unprofessional” clothes are discouraged (no tank tops, shorts,

Can my husband DoorDash for me?

DoorDash does allow someone else to ride with Dashers on deliveries. So unlike Instacart, Dashers can bring a friend, child, or spouse as long as their presence does not interfere with your work. Being an independent contractor (and not an employee), you have some leeway in how you conduct your work.

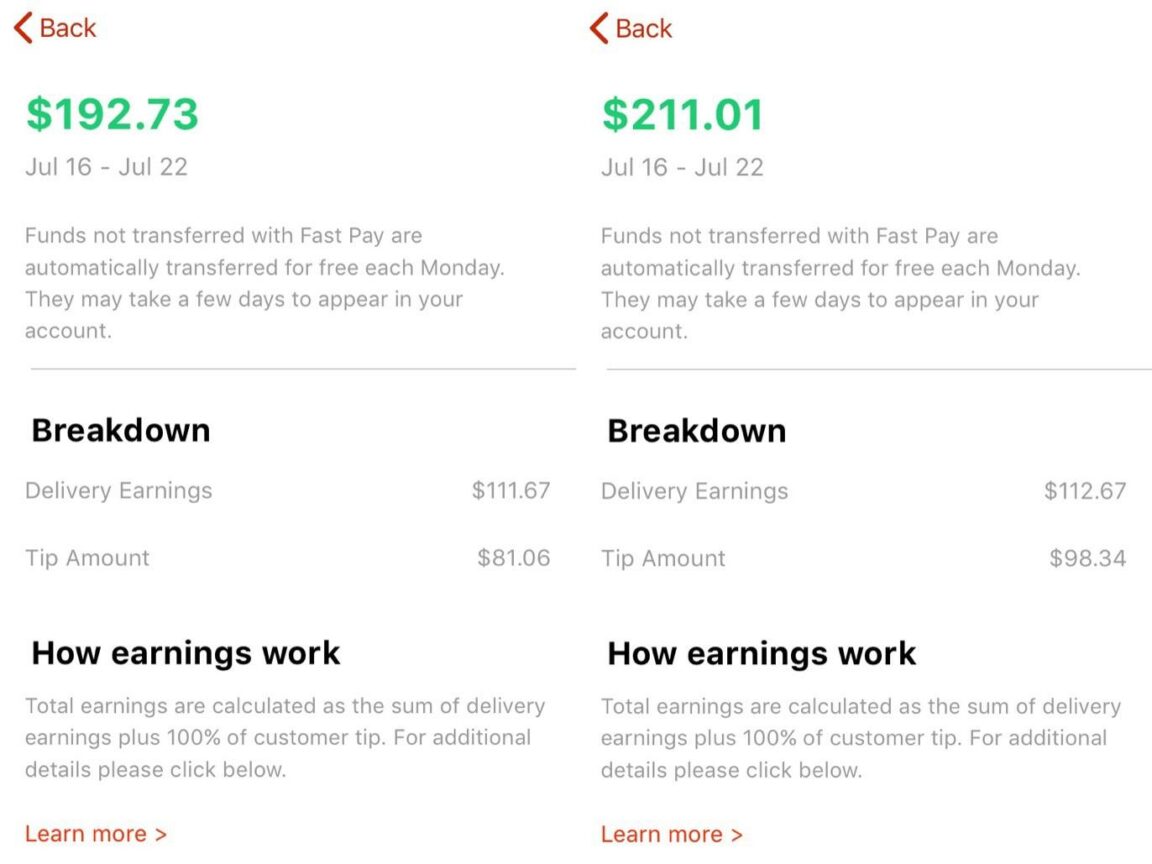

How much can a door dasher make a week?

In my experience, you can expect to earn anywhere from $10-$25 hourly. Over the course of a month in 2020, I earned an average of $183.51 weekly by working an average of 9 1/4 hours. That means I made around $19.84 an hour. Below, you can see a breakdown of earnings from one of those weeks.

How much do you make door dashing a week?

The answer is YES. You can make $500 or $1,000 a week delivering with DoorDash. Several users on Quora, Reddit, and YouTube have made such amounts working as Dashers. But there are various factors that determine how much you can earn per day, week, or month as a Dasher.

Can you write off gas on taxes for DoorDash?

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can’t deduct mileage and gasoline at the same time.