Can I write off my car payment if I drive for Uber?

You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving.

Subsequently, Can I claim my Uber rides to work on my taxes?

Unfortunately, “commuting” in any form is not deductible, including ridesharing services such as Uber & Lyft. Similar to taking the bus, hailing a cab, or riding the train, these are not deductible, even if they are being taken in order to get to work.

How much does Uber pay per mile 2021?

The cost per mile will change based on the type of fare that you purchase and other factors like location but generally you can expect to be charged between $1 to $2 per mile.

How much should Uber drivers set aside for taxes?

Income taxes

The amount you’ll pay depends on the amount and types of other income you have, your filing status, the tax deductions and credits you’re eligible to claim, and your tax bracket. A good rule of thumb is to set aside 25-30% of your net income to cover self-employment and income taxes.

Does Uber report to IRS?

Every year, Uber will file IRS Form 1099-MISC and/or 1099-K with the IRS and your state tax agency reporting how much it paid you. This applies if you were paid over $600 during the year.

How do I avoid paying taxes with Uber?

Make estimated payments throughout the year to avoid a penalty. File your taxes. You’ll need to file Schedule C and Schedule SE with Form 1040. You’ll find your rideshare income information on your driver dashboard.

How much do Uber drivers pay in taxes?

Note that the rates below ill be the same for the 2021-22 financial year. So for example if you earn $30,000 from your employee job, and you have $5,000 of Uber profits for the financial year, your Uber profit will be taxed at 21% (that’s the rate above of 19% + the 2% Medicare Levy).

How much do I have to make to file taxes for Uber?

The IRS rules do not require Uber to issue a 1099-K if you processed fewer than 200 transactions or earned $20,000 or less in payments. Likewise, Uber isn’t required to provide a 1099-NEC if your non-driving income was less than $600.

Can you make $5000 a month with Uber?

Former Uber driver Crisia Nuñez humbly shares how she makes $5,000 a month with her new hustle as a launderer using SudShare, a laundry-service app.

What’s the highest paid Uber driver?

Buzzfeed analyzed the pay of 11 full- and part-time Uber drivers. They made anywhere from $3.99 an hour to $31.44 an hour (after expenses). The second highest paid driver was a 21-year-old student who made $29.57.

Is Uber a good side hustle?

While it certainly has competitors (think: Lyft), Uber is one of the most flexible side hustles anyone can find.

What expenses can an Uber driver deduct?

You can deduct the actual expenses of operating the vehicle, including gasoline, oil, insurance, car registration, repairs, maintenance, and depreciation or lease payments. Or you can use the standard IRS mileage deduction. For the 2021 tax year, that rate is 56 cents/mile of business use.

Do I have to report Uber income under 600?

I drive for Uber and Lyft but made less than $600 from each company and was not sent a 1099 from either company. what should I do? You do not need to 1099 from either Uber or Lyft to report your self-employment income.

Do you need gas receipts for taxes?

If you’re claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be written off.” Just make sure to keep a detailed log and all receipts, he advises, or keep track of your yearly mileage and then deduct the

Can I do Uber and collect unemployment?

While these pandemic unemployment assistance measures stay in place, an Uber driver can claim unemployment benefits as a gig worker.

How does Uber affect your Social Security benefits?

All countable income will reduce your SSI check dollar-for-dollar. The SSI federal benefit amount is $794. If you have $600 a month in countable income from Uber or some other source, your SSI check would be only $194. Countable income of $794 or more a month will eliminate your SSI benefits.

Do I have to declare Uber income?

When you drive with the Uber driver app, you’re an independent contractor. Similar to a small business owner, you’ll want to report your income for the year and pay applicable taxes. This applies to earnings on both Uber rides and Uber Eats.

Do you get w2 for Uber?

Uber, however, will not send you a W-2. Instead, it will report your earnings on two other forms: Form 1099-K for your driving services and. Form 1099-NEC (Form 1099-MISC in years prior to 2020) for any other income you’re paid, such as bonuses or referral fees.

Can I drive for Uber under a company name?

By default, drivers are individuals/sole proprietors, but Uber also allows drivers to operate under the following tax classifications: Individual/Sole Proprietor. C Corporation. S Corporation.

How much should I set aside for taxes Uber Eats?

The amount you’ll pay depends on the amount and types of other income you have, your filing status, the tax deductions and credits you’re eligible to claim, and your tax bracket. A good rule of thumb is to set aside 25-30% of your net income to cover self-employment and income taxes.

What is a diamond Uber driver?

You unlock Diamond by earning 7,500 points for your rides and Uber Eats orders. Diamond benefits include premium support for both rides and Eats, matching you with more highly-rated drivers, 3 Uber Eats orders with a $0 delivery fee, as well as complimentary ride upgrades when available.

Does Uber or Lyft pay more?

If you’re simply looking at which company’s drivers make more, Lyft’s hourly average of $17.50 is higher than Uber’s average of $15.68. Lyft also boasts better driver satisfaction.

How much does a 20 minute Uber cost?

The cost of a 20-minute Uber ride can cost as low as $20 on the low end to $50 on the high end. The variable cost will depend on the area, total mileage, and vehicle. The cost for a 20-minute ride in your area may not be the same as it is in another area.

Can you make 100k driving Uber?

Inspiring: Local Uber Driver Makes $100k A Year Driving 84 Hours A Week. You can’t, you won’t, please don’t. Over the weekend, a video following one UberEats driver’s progress towards $100,000 a year went viral—brought to you by Grow, a sponsored content partnership between CNBC and Acorns, a financial services company

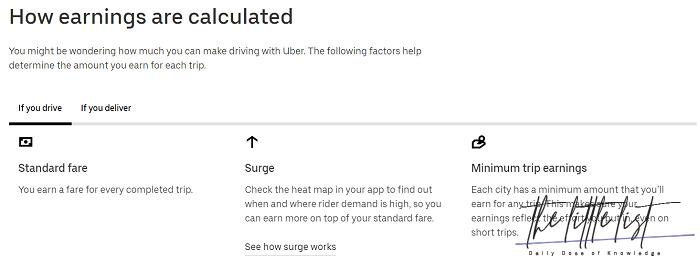

How do I maximize my Uber earnings?

7 Ways to Boost Your Uber Earnings

- Keep Snacks and Water Handy.

- Know the Local Bathrooms.

- Don’t Follow the Herd.

- Drive up the Surge Fares.

- Don’t Drive Around Endlessly.

- Don’t Chase Surge Fares (but If You Do, Try This Hack)

- Use the Uber Passenger App.

In what city do Uber drivers make the most money?

New York City, New York

Of course, New York is on the list, and it is the city where Uber drivers earn the most considerable amount of money per hour.