Can I use my DoorDash card for gas?

Can Doordash drivers use their card to pay for gas? No, first of all, Dashers are independent contractors. DoorDash, as well as Lyft, Uber, or Postmates, don’t pay for gas or tickets for car maintenance. You cannot use the Doordash driver red card for gas or for yourself or personal use.

Then, Do you have to pay for your own gas with DoorDash?

DoorDash does not pay for gas. The driver is responsible for their own gas and any other costs associated with the vehicle and vehicle maintenance. Anyone who works for DoorDash is considered an independent contractor and is not entitled to any employer benefits.

Can someone ride with you while you DoorDash?

Yes, as an independent contractor there are no rules against having any passengers, including friends!

Do you pay taxes on DoorDash?

Yes, you will have to pay taxes just like everyone else. If you made more than $600 working for DoorDash in 2020, you have to pay taxes. This isn’t exclusive to only DoorDash employees, either. If you took on some side jobs to make up for lost income, that money you made will be taxed.

Do you get a w2 from DoorDash?

A: The only tax form that eligible Dashers will receive is the 1099-NEC, and this is ONLY for Dashers who earned $600 or more on the platform in 2021.

Can someone ride with you while doing DoorDash?

Your friend’s in luck—someone can ride with you while driving for DoorDash. Of the food delivery services, DoorDash is one of the more relaxed when it comes to rules. As long as you deliver your orders on time, they don’t make a fuss about how you do it.

Does DoorDash take out your taxes?

Here’s the important information we’ll talk about in this overview. No taxes are taken out of your Doordash paycheck. You will file your own taxes on Doordash (and other independent contractor work) income as a business owner. You’re taxed based on profit, not on the money you get from Doordash.

Does DoorDash give you a W2?

No, DoorDash does not send its delivery drivers a W2 form. Rather, DoorDash provides its DoorDashers with a 1099-NEC form, but only if they earned over $600 during the year. Further, DoorDash partners with a company called Stripe to provide a 1099-NEC form.

Can two door Dashers use the same car?

Yes me and my husband are both door dashers and we ride together now we always make sure the food is in side of the doordash bags zipped shut the only time it isnt is if its too big of an order in which we make sure its on back seat and nobody touches it .

What do you wear while door dashing?

There are no official uniform requirements. But “revealing” or “unprofessional” clothes are discouraged (no tank tops, shorts,

Can couples DoorDash?

DoorDash allows Dashers to deliver with a partner. This creates a lot of convenience for the Dasher as they can take turns driving and running errands for each other. Just make sure the partner is not engaging with the restaurant or the customer unless they are also contracted with DoorDash.

Can you write off car payments for DoorDash?

Careful—you can’t deduct both mileage and gas at the same time! The standard mileage deduction (56 cents per mile in 2021 and 58.5 cents per mile in 2022) is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation.

Does DoorDash reimburse for mileage?

DoorDash doesn’t pay for its delivery drivers’ mileage. This is because when you deliver for DoorDash, you’re an independent contractor, and therefore are responsible for providing your own car, its repairs, gas, mileage, etc.

What can I write off as a DoorDash driver?

Here is what you can Write Off as a DoorDash Driver

- Mileage.

- Parking.

- Tolls.

- Cell Phone.

- Insulated Courier Bags.

- Inspections.

- Repairs.

- Health Insurance.

What if I made less than 600 with DoorDash?

Do I have to pay taxes if I made less than $600 with Doordash? Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes.

What will disqualify you from DoorDash?

These include but are not limited to DUI, driving with a suspended or expired license, and failing to stop and report an accident. Certain violent crimes will also disqualify you from driving for DoorDash. DoorDash also requires that its drivers do not have more than three “incidents” in the last three years.

Can DoorDash drivers see tip?

Do DoorDashers See Your Tip Before They Accept The Delivery? Yes, DoorDashers can see how much you will tip before accepting the delivery order. However, the DoorDash drivers can only see your tip amount if you place it before completing your order.

Does DoorDash track your miles?

DoorDash doesn’t keep track of your mileage as a delivery driver, so you can’t just login to your Dasher app and get a tax-ready print out of all the mileage you drive for DoorDash.

How much should I put aside for taxes DoorDash?

Generally, you should set aside 30-40% of your income to cover both federal and state taxes. Whether you file your taxes quarterly or annually, you need to set aside a portion of your income for your taxes.

Can delivery drivers write off gas?

Self-employed individuals can deduct their non-commuting business mileage. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day. Careful—you can’t deduct both mileage and gas at the same time!

How much should I set aside for taxes DoorDash?

It’s a little complex, and the IRS has more information for how this works (plus a handy withholding estimator tool). Here’s a good bit of advice for the future: Set aside 25-30% of every paycheck for taxes. I know, that’s a lot. But since taxes from your side hustle aren’t withheld, you should be prepared.

Can you have your dog while Doordashing?

You don’t have to do anything different. Just sit and stay where you are, and let your very own Doggy Dasher take care of the work. Here at DoorDash we’re all about eating our own dog-food, and have been piloting DoggyDash internally for the last few weeks, so we know it’s the best of breed.

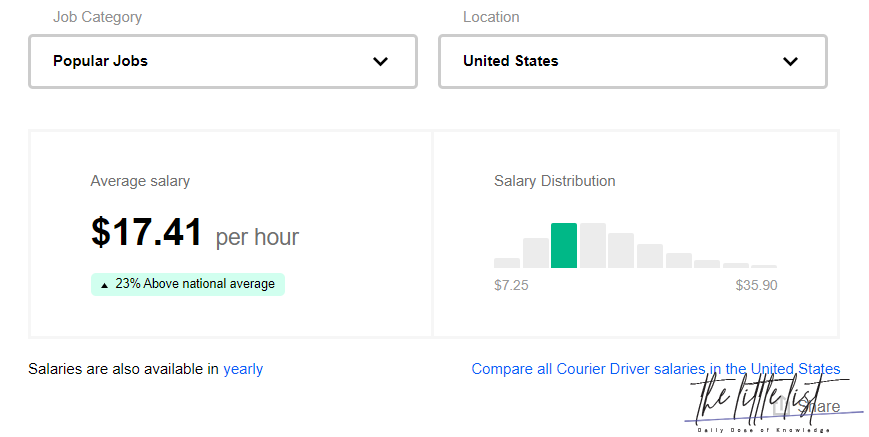

What delivery service pays the most?

10 best paying food delivery services

- Instacart. Salary: the typical Instacart delivery driver earns $29 per hour1 and about $25,165 per year6.

- Shipt.

- Uber Eats.

- Amazon Flex.

- 5 DoorDash.

- Postmates.

- Caviar.

- Grubhub.

Can you live off DoorDash?

Living off DoorDash is likely possible if you live in a low cost of living area and don’t have any dependents. But, your income goals also influence if this is the right decision. For example, if you want to grow your wealth, you probably want to aim for a decent job with a good salary.

Do I need a hot bag for DoorDash?

In order to ensure standards of food safety, merchants may require all Dashers to have an insulated hot bag during their deliveries. You may use any hot bag of your choice. To get a DoorDash hot bag, you can purchase one online at www.doordashstore.com.

How many times can you dash a day?

Plus you can get 2% back on gas anywhere when you use your DasherDirect Business card. Learn how here. As a Dasher, you choose both when and how much (or how little) you’d like to dash. You can dash all day every day or a little here and there – no commitment required!