Is Venmo safer than PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice.

Subsequently, What is best payment app?

The 6 Best Payment Apps of 2022

- Best Overall: PayPal.

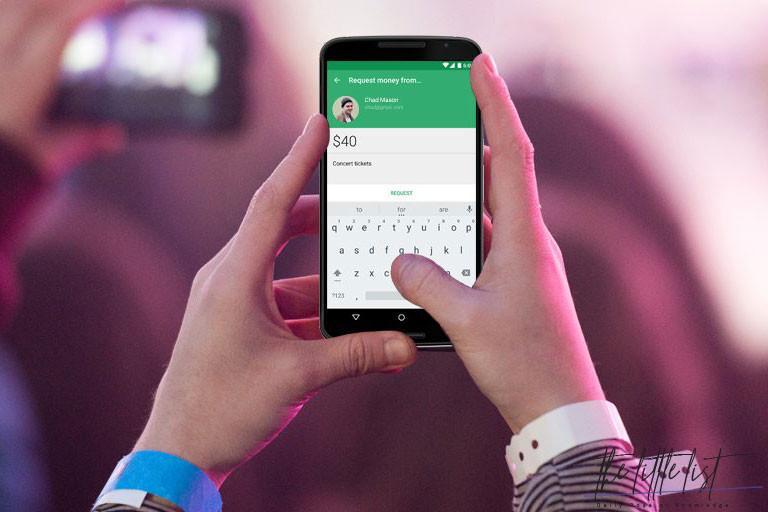

- Best for Friends: Venmo.

- Best With No Frills: Cash App.

- Best for Banking: Zelle.

- Best for Google Accounts: Google Pay.

- Best for Social Media: Meta Messenger.

What is the safest app to transfer money?

Select’s picks for the top apps to send money

- Best between friends: Venmo.

- Best for bank-to-bank transfers: Zelle.

- Best for flexible payments: PayPal.

- Best for budding investors: CashApp.

- Best for sending money internationally: Remitly.

What are the cons of Venmo?

What Are the Cons of Venmo?

- Fees for some services.

- Privacy may be compromised unless you adjust privacy settings.

- Money is unavailable instantly unless you pay a fee.

- No ability to earn interest on money on money deposited with Venmo.

Does Venmo charge a fee?

Standard Venmo services are offered completely free of cost, which means that for the majority of users, Venmo is cost-free. Therefore, sending money to friends and family using a debit card or checking account is completely free of charge.

What is the safest Cash App to use?

Mobile payment apps’ security and privacy

| Security page | Bug bounty program | App or transaction lock |

|---|---|---|

| PayPal Mobile Cash | Yes | App |

| Zelle | Yes | App |

| Square Cash (Cash App) | Yes | Transaction |

| Apple Pay | Yes | Transaction |

• Aug 20, 2020

Is PayPal safe?

PayPal is a highly secure financial service, backed with some of the best end-to-end encryption available. You should also make sure to enable two-factor authentication, and delete any unused bank accounts or email addresses. Even with all this security, remember that no online service is immune to hacking or theft.

Is Venmo owned by PayPal?

Venmo is an American mobile payment service founded in 2009 and owned by PayPal since 2012.

What banks work with Cash App?

Supported Cards with Cash App

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported, but depositing to these cards does not work. ATM cards, Paypal, and business debit cards are not supported at this time.

Why you shouldn’t use Cash App?

Although the app is legitimate, you should use it cautiously. Scammers have found ways to defraud people using the app, so only send and accept money from people you trust.

Why is Venmo asking for my SSN?

Why are you asking me to do this? Verifying your identity allows you to make payments using the money in your Venmo account and can enable you to send and transfer greater amounts of money on Venmo. Venmo is required by federal law to collect certain information from all its users that have access to a balance.

Is Zelle better than Venmo?

Is Zelle Faster Than Venmo? Both peer-to-peer apps are fast, but Zelle is the fastest — and it’s free. Zelle transfers happen almost instantly. Venmo funds take one to three business days unless you pay a 1.5% transaction fee for an instant transfer, which is available in minutes.

How much is the PayPal fee for $100?

PayPal’s payment processing rates range from 1.9% to 3.5% of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. The exact amount you pay depends on which PayPal product you use. This might not seem like a large amount, but a $100 transaction will cost you between $2 and $3.99.

How much do PayPal take in fees?

As we said before, the standard rate for each transaction made using PayPal is 2.9% plus 30 cents.

Can you get scammed on Venmo?

Hackers have discovered that they can use Venmo to trick users into providing their bank account information or Social Security numbers. Scammers have also used Venmo to make fraudulent purchases, leaving sellers without the product they were selling or any of the dollars they thought they were making from the sale.

Can your Cash App be scammed?

Fraudsters often attempt to steal customer data and gain access to accounts by pretending to be a Cash App customer service representative. If someone claiming to be a Cash App service representative asks for your sign-in code or PIN, asks for you to send them money, or asks for personal information, it’s a fraudster.

Is Zelle or Cash App better?

Zelle allows domestic bank to bank transfers, whereas Cash App can be used to deposit money internationally, paid for by bank transfer or debit card. Also, Cash App allows transfers in the UK, but Zelle is limited to the US.

What are the disadvantages of PayPal?

Cons of using PayPal for small business

- High chargeback fees.

- Higher fees than a typical merchant (credit card processing) account.

- Account suspension for terms and conditions (T&C) violations that can freeze your funds for months.

- May take 2 business days to get your money.

- Customer service can be hard to reach.

What is the safest payment method online?

By and large, credit cards are easily the most secure and safe payment method to use when you shop online. Credit cards use online security features like encryption and fraud monitoring to keep your accounts and personal information safe.

Is Cashapp safe?

Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Any information you submit is encrypted and sent to our servers securely, regardless of whether you’re using a public or private Wi-Fi connection or data service (3G, 4G, or EDGE).

How do I avoid PayPal fees?

8 Easy Ways to Decrease or Avoid PayPal Fees

- Opt to Be Paid Less Often.

- Change How You Withdraw Your Money From PayPal.

- Use Accounting Software to Lower PayPal Fees.

- Ask to Be Paid as a Friend or Family.

- Factor PayPal Fees into Your Payment Equation.

- Accept Other Forms of Payment.

- Use a PayPal Alternative.

Is there fees for PayPal?

Finally, if you were to sell items and use PayPal as your payment processor, you’ll pay fees on each transaction: Sales within the US: 2.9% plus 30 cents. Discounted rate for eligible charities: 2.2% plus 30 cents. International sales: 4.4% plus a fixed amount which varies by country.

How is Venmo different from PayPal?

Where they differ slightly is that Venmo extends its no-fee option to payments made from debit cards, while PayPal only allows free payments directly from a bank account. For debit and credit card payments, PayPal’s fee is technically 2.9% plus 30 cents. See more about Venmo’s and PayPal’s fees.

Can money be stolen from Cash App?

But all the security and encryption in the world won’t stop everyone from falling for a ruse. After all, scammers gonna scam. That being said, there is a lot you can do to protect yourself… and your money. First off, you should know that any money-transfer app, including the Cash App, is susceptible to money fraud.

Can I use Cash App without a bank account?

Yes, users can enjoy Cash App without a linked bank account, which is good news for those that do not have a bank account or would rather not link it to a third-party app. Because of this facility, users can send and receive money to and from your customers using the app alone.

Why does Cash App need my SSN?

In order to keep the app safe and free from fraud and scams, they verify every user’s identity. Like most financial institutions, they do this by requesting your SSN. Now, it’s important to clarify that you’re able to download Cash App and create an account without a SSN.