How much will Cleo let me borrow?

Cleo Plus is $5.99/month and includes Cleo Cover, which is an overdraft service. If you qualify, Cleo will let you borrow up to $100 for overdrafts. This no-interest loan has to be paid back between 3 and 28 days. Once the loan has been paid back, another can be requested.

Then, What happens if you dont repay Cleo?

If you can’t repay the loan on time, the lender can: charge you 2.5% interest for every month you don’t pay. sue you in court or send your file to a collection agency. charge you late fees.

What credit score do you need for a 1000 dollar loan?

Every lender and bank is different, so some will have stricter credit score requirements than others. However, most lenders look for at least a credit score of 610. With a small personal loan amount of $1,000, they may be willing to qualify borrowers with a score below 610.

What app will give me money instantly?

1. Earnin – Best for hourly workers. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached. When users sign up for the app, Earnin connects their bank accounts to verify their payment schedules.

What bank does the Cleo app use?

Yes, Cleo works with Chime. This means once you register an account with Cleo, become Cleo plus member, and get approved for a cash advance that can go up to $100, you can transfer it to your Chime account. This means users need to add their Chime bank account on the Cleo app before proceeding with this operation.

Does Cash App let you borrow money?

Yes, Cash App makes loans of $20 to $200, according to a 2020 TechCrunch article. Cash App tested the Borrow feature with a limited roll-out to 1,000 users. While the company hasn’t disclosed the status of that testing, the app does note that Borrow is still not available to all customers.

How do I withdraw from Cleo?

How do I withdraw from my Cleo Wallet? If you’d like to withdraw money from your Cleo Wallet, just say ‘withdraw’ to Cleo, followed by the amount you would like to take out e.g. ‘withdraw $5’. The money will then return to the account attached to your Cleo Wallet within four working days.

Does Cleo work with Cash App?

Some of the popular cash advance apps include Dave, Brigit, Cleo, Albert, Earnin, MoneyLion, Klover, etc. However, not all cash advance apps are supported by Cash App.

Is Credit Karma a reliable credit score?

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Can I get a loan with a 577 credit score?

Conventional mortgage lenders will most likely decline your application with a credit score of 577, as the minimum credit score is around 620. However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%.

Is MoneyLion legit?

Their site and application process are streamlined and simple, they offer reasonable interest rates, and they provide high-quality and reliable support. Financer.com can gladly say that MoneyLion is an excellent option when you’re in need of a loan or other financial services.

How can I borrow $50 from Cash App?

How To Borrow Money From Cash App Borrow

- Open Cash App.

- Tap on your Cash App balance located at the lower left corner.

- Go to the “Banking” header.

- Check for the word “Borrow.”

- If you see “Borrow,” you can take out a Cash App loan.

- Tap on “Borrow.”

- Tap “Unlock.”

- Cash App will tell you how much you’ll be able to borrow.

What app will give me $50 instantly?

Get a $50 instant loan with these apps that have fast approval to solve your financial needs!

Try these free mobile applications available in the App Store and Google Play Store — so you can borrow money online and get $50 instantly.

- Chime.

- Empower.

- Albert.

- Earnin.

- Brigit.

- MoneyLion.

- Cleo.

- Branch.

Can I borrow money from PayPal?

The process is easy: Select your loan amount. The maximum loan amount depends on your PayPal account history. Choose the percentage of your PayPal sales that will go toward repaying your loan and fee.

Why can’t I connect my bank to Cleo?

It’s usually an issue with your bank being slow to open or close a connection and our system throws an error. Usually trying again or coming back at a later date works best for now. We’re working with the banks to make this more reliable!

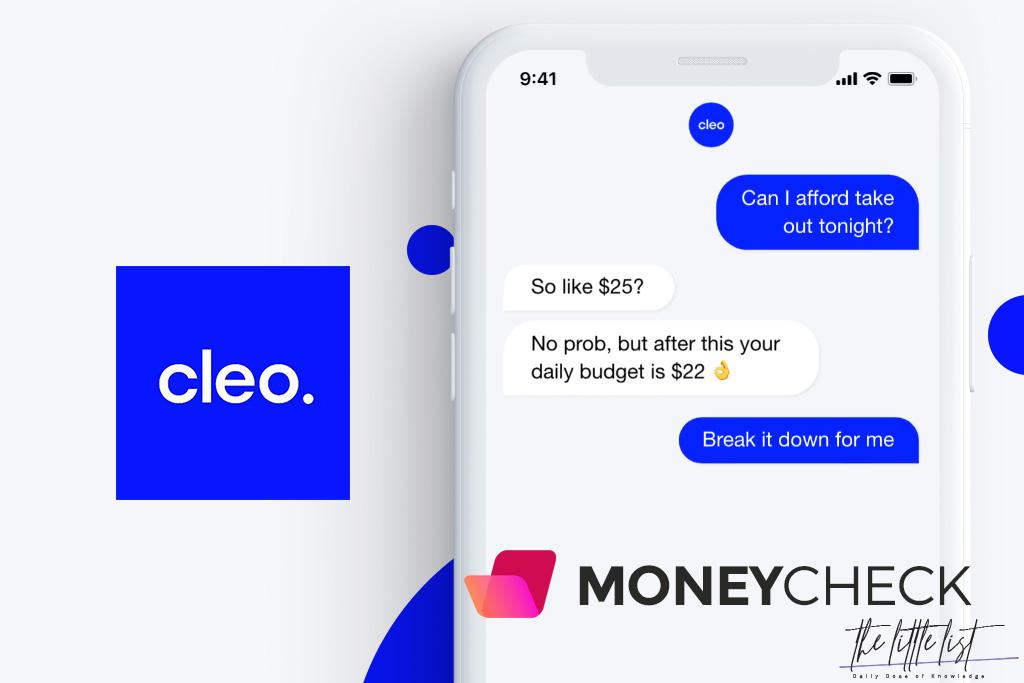

Is Cleo advance instant?

That’s why Cleo let’s you borrow money instantly (up to $100 interest free) whenever you need it. But she’s not just a loan app. After you get a quick spot, she’ll also help you build up your own emergency fund and chime in whenever you’re headed for trouble. As many as you want!

What apps will let me borrow money instantly?

Here are five apps that let you borrow against future earnings, and some less expensive options to consider.

- Earnin: Best for low fees.

- Dave: Best for small advances.

- Brigit: Best for budgeting tools.

- Chime: Best for overdraft protection.

- MoneyLion: Best for multiple financial products.

Can I borrow money on venmo?

How to Borrow Money from Venmo? Yes, you can borrow money from Venmo and get Venmo loans up to $5,000. And much like regular bank loans, Venmo will take a small amount from your cash balance every month as an interest fee until you fully pay the loan back.

What bank does Cleo use?

credit life. *Cleo Credit Builder Card issued by WebBank, Member FDIC.

Is Cleo a credit card?

The Cleo Card is a charge card, which means you must pay off your balance in full at the end of each month. This can help you develop strong credit habits and ensures your purchases never rack up interest. Rewards.

What is the most accurate credit score app?

5 Best Credit Score Monitoring Apps of 2022

- Credit Karma. CreditKarma. According to users, Credit Karma’s scores are close to their actual FICO scores.

- Credit Sesame. Credit Sesame. Free identity theft protection and financial advice at your fingertips.

- Mint. Mint.

- CreditWise by Capital One. CreditWise.

- myFICO. myFICO.

Is 650 a good credit score?

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

What is a good FICO score?

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®‘s industry-specific credit scores have a different range—250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Can you get a home loan with 520 credit score?

The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

What is a 600 credit score?

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Is 555 out of 710 a good credit score?

A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent (reference: https://www.finder.com/uk/transunion). Equifax scores range from 0-700.