How do I withdraw money from my Current Account?

You can visit your bank and fill out a form with your account information and amount you want to take out and present it to a teller. Work with a bank teller. Let the teller know you don’t have a card, and they can walk you through the bank’s process of retrieving money from your account.

Then, Do you need a bank account for current?

No account fee: Both the Current and Teen accounts are free for users. Mobile check deposit: Not all online banks offer mobile check deposit, but Current does.

How do I put money in my current account?

Instantly add cash to your account

- Open the Current app and go to the Money tab.

- Find a location near you on the ‘Add Cash’ map.

- Generate a barcode and hand it with your cash to the cashier.

- Funds are instantly available in your account.

Can we transfer money to current account?

You can initiate inter-bank transfers via facilities like RTGS, NEFT, and IMPS. You will need details such as the account number and IFSC code of the Recipient to initiate such transfers. You can also transfer funds to other bank accounts via UPI, where you only need the beneficiary’s mobile phone number.

What ATM does current use?

As a Current Account member, you can withdraw your money without any fees at over 40,000 in-network Allpoint ATMs in the U.S. Current is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC.

How do I put money on my current card?

Instantly add cash to your account

- Open the Current app and go to the Money tab.

- Find a location near you on the ‘Add Cash’ map.

- Generate a barcode and hand it with your cash to the cashier.

- Funds are instantly available in your account.

Why does current ask for SSN?

Yes, Current requires a U.S. Social Security Number (SSN) to open an account. Your Social Security Number helps us validate your identity and protect your platform.

Where can I put money on my current card?

We’re happy to announce that Current’s over 1 million members now have the ability to add cash instantly to their accounts at over 60,000 stores nationwide, including CVS Pharmacy, 7-Eleven, Dollar General and Family Dollar. Paid in cash? No need to even visit an ATM to deposit your money.

How much cash can I deposit in current account?

The account provides 25 free transactions per month and offers a free cash deposit facility of up to Rs. 2 lakhs in home branch and Rs. 1 lakh in other branches.

How much cash can you pay into a current account?

How much cash can you deposit in a bank UK authorities accept as coming from a legitimate source? You can deposit as much money as you’d like, but we recommend making deposits of up to £1,000 several times a month to avoid red flags.

Is current a prepaid card?

Current – This is not a prepaid card.

Can I transfer money from current account to saving account?

As a result, as per the Reserve Bank of India regulations, you cannot convert a Savings Account into a Current Account and vice versa.

Which is best app for money transfer?

Compare the Best Money Transfer Apps

| App | Operating System |

|---|---|

| PayPal Best Overall | iOS and Android |

| WorldRemit Best for International Transfers | iOS and Android |

| Cash App Best for Low Fees | iOS and Android |

| Venmo Best for Shared Bills | Apple iOS 10.0 or Android Lollipop (API 21) or higher devices |

Is there an app to transfer money from one bank to another?

Cash App: Another popular peer-to-peer payment app is Cash App, which lets you send money to another user’s bank account or debit card. Users can also set up direct deposit, so that any funds they receive automatically go into their bank account.

Does current send you a card?

Since your Current card is typically delivered within 7-10 business days of being issued, here are some ways for you to access your funds and add money to your account while you wait for your card to arrive: Add your virtual card to services like Apple Pay and Google Pay or use it to shop online.

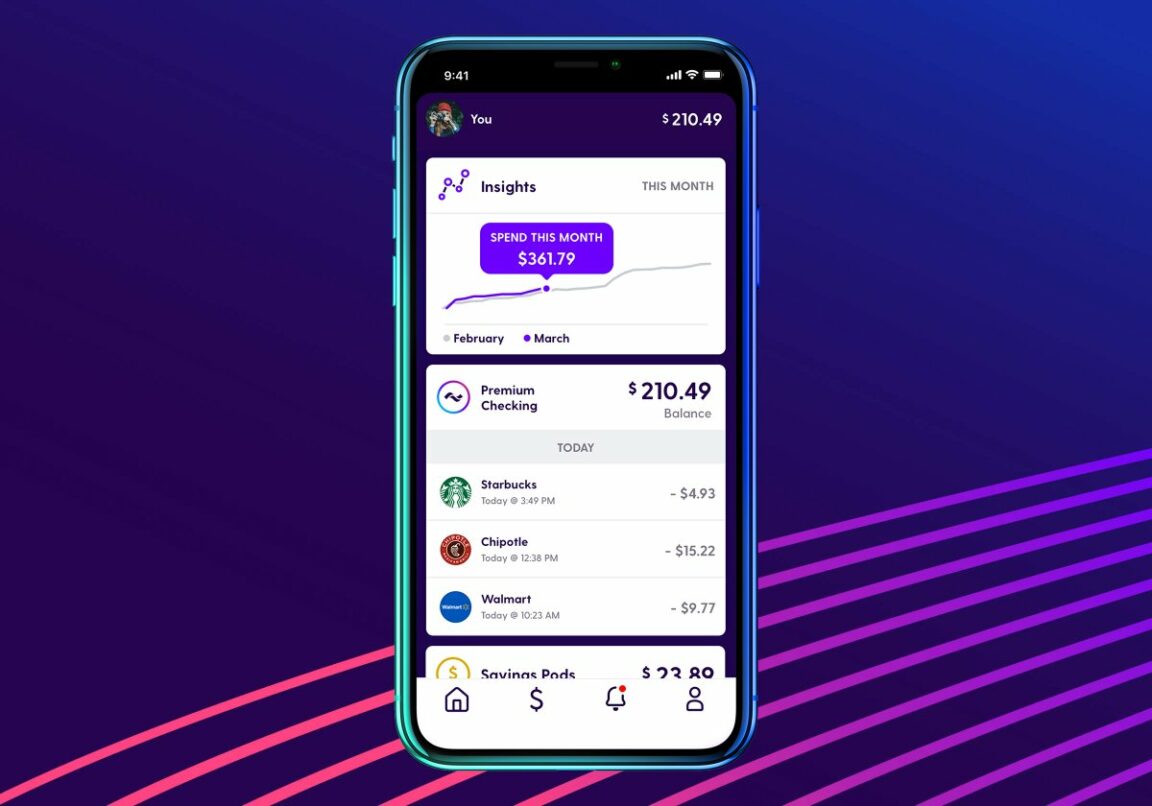

Is current a credit card?

Current is a financial mobile app with a Visa debit card, aimed at modern families. It enables clients to deposit money on their accounts faster, manage their budgets, and withdraw cash on over 55,000 ATM locations across the country.

How much does it cost to add money on current?

Is there a fee to add cash? Yes, there’s a small fee of $3.50 per transaction, which is lower than what other accounts charge.

How much cash can I deposit in Current Account?

The account provides 25 free transactions per month and offers a free cash deposit facility of up to Rs. 2 lakhs in home branch and Rs. 1 lakh in other branches.

Is current bank legit?

Yes. Current Bank is safe and trustworthy. The company has a user base of 3 million customers and high ratings in the Google Play and App Stores. It’s a trustworthy online bank, and it has FDIC insurance from its backers (Metropolitan Commercial Bank and Choice Financial Group).

Is current a debit card?

The bottom line: Current is a neobank, a nonbank financial technology company that relies on a partner bank to provide FDIC insurance for customers’ deposits. Accounts are accessed primarily through the Current mobile app. Current offers a rewards debit card, plus an interest rate of 4.00% on its Savings Pods.

How do I check to see if someone is using my Social Security number?

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus (Equifax, Experian and TransUnion).

Can I refuse to give my Social Security number?

Anyone can refuse to disclose his or her number, but the requester can refuse its services if you do not give it. Businesses, banks, schools, private agencies, etc., are free to request someone’s number and use it for any purpose that does not violate a federal or state law.

What can someone do with the last 4 digits of your SSN?

As long as a hacker or scammer has access to other personal information such as your name and address, they can use the last four digits of your SSN (in most cases) to open accounts in your name, steal your money and government benefits, or even get healthcare and tax refunds in your name.

What ATMs can I use with current?

As a Current Account member, you can withdraw your money without any fees at over 40,000 in-network Allpoint ATMs in the U.S.