How do I avoid PayPal fees friends and family?

You have two options: either ask them to pay directly and select the “Family and Friends” option, or you can send them a separate invoice via another payment service. There’s no payment protection for payments made through the “Family and Friends” option.

Then, Who pays the fee on PayPal?

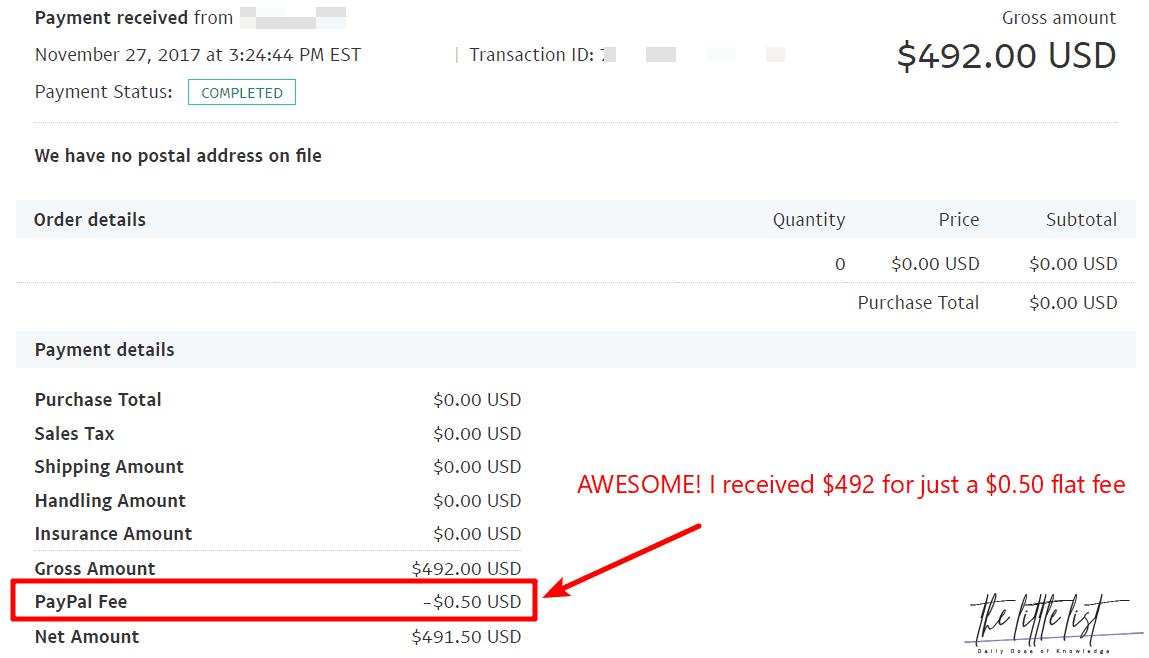

When completing a transaction through PayPal, the seller must pay a PayPal fee. The buyer isn’t forced to pay any fee. The fee the seller pays is calculated for each transaction and is represented as a percentage of the total transaction plus 30 cents.

Why is PayPal charging me a fee for friends and family?

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money. If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Which is better venmo or PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice. Sign up for Venmo now.

How much is the PayPal fee for $100?

PayPal’s payment processing rates range from 1.9% to 3.5% of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. The exact amount you pay depends on which PayPal product you use. This might not seem like a large amount, but a $100 transaction will cost you between $2 and $3.99.

Which is better Venmo or PayPal?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice. Sign up for Venmo now.

How can I receive money without fees?

Venmo is available for Android and iOS. Verified accounts can send up to $4,999.99 per week. Venmo doesn’t charge a fee for sending or receiving money via balance, bank or debit card.

Why you shouldn’t use Venmo?

Venmo Prohibits It

Venmo may NOT otherwise be used to receive business, commercial or merchant transactions, meaning you CANNOT use Venmo to accept payment from (or send payment to) another user for a good or service, unless explicitly authorized by Venmo.

Which is safer Zelle or PayPal?

However, while Zelle may appear more secure, applications like Venmo and PayPal are just as secure. All of them use data encryption to protect users against unauthorized transactions and store users’ data on servers in secure locations. Venmo also offers users the ability to set a PIN code for access to the mobile app.

Is Zelle owned by PayPal?

Zelle (/zɛl/) is a United States–based digital payments network owned by Early Warning Services, LLC, a private financial services company owned by the banks Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

How much does it cost to send $1000 on PayPal?

Sending/Withdrawing/Transferring Money

30 for U.S. transactions. *Example: You send $1,000 to a friend and you have to use your linked debit card to cover the payment, you will pay the $1,000 + $29 (transaction fee) $. 30 fixed fee.

Does Venmo charge fees to receive money?

First, Venmo does not charge a fee for receiving money and making payments to authorized businesses. If you are buying a good or service with a business that has an option to pay through Venmo (and has been authorized by Venmo) then you won’t be charged a transaction fee to do so.

Can you get scammed on PayPal?

Despite its advantages, however, PayPal still has one thing in common with traditional credit card payments: fraud. Like any other payment processor, PayPal faces a ceaseless onslaught of scams and fraud attempts trying to take money out of someone else’s pocket.

Do you pay fees on PayPal friends and family?

Legitimate traders can also benefit from being paid via ‘friends and family’ because those paid via it aren’t charged a fee, unlike with the ‘goods and services’ option.

Is Zelle safer than Venmo?

Generally speaking, Zelle and Venmo are safe to use. Both incorporate security features into their apps, such as data encryption, purchase verification, multifactor authentication and fraud protection.

Does Zelle charge a fee?

Zelle® doesn’t charge a fee to send or receive money. We recommend confirming with your bank or credit union that there are no additional fees. Was this helpful?

Does Venmo charge a fee to receive money?

First, Venmo does not charge a fee for receiving money and making payments to authorized businesses. If you are buying a good or service with a business that has an option to pay through Venmo (and has been authorized by Venmo) then you won’t be charged a transaction fee to do so.

What is the safest way to receive money from a buyer?

What Are the Most Secure Payment Methods?

- Payment Apps. Mobile payment apps are designed to free you from cash and credit cards by allowing you to digitally transfer funds to family, friends, or merchants.

- EMV-Enabled Credit Cards.

- Bank Checks.

- Cash.

- Gift Cards.

- Stay Protected.

Why you should not use Zelle?

The biggest drawback of Zelle is that it doesn’t offer fraud protection for authorized payments. In other words, if you purchase something online and use Zelle to pay for it, you have no recourse if you never receive the item you paid for.

Does Venmo charge a fee?

Standard Venmo services are offered completely free of cost, which means that for the majority of users, Venmo is cost-free. Therefore, sending money to friends and family using a debit card or checking account is completely free of charge.

Which is better Zelle or Venmo?

Is Zelle Faster Than Venmo? Both peer-to-peer apps are fast, but Zelle is the fastest — and it’s free. Zelle transfers happen almost instantly. Venmo funds take one to three business days unless you pay a 1.5% transaction fee for an instant transfer, which is available in minutes.

Can I send $5000 through Zelle?

You can send up to $5000 per day and make 10 transfers a day. You can also transfer money to other Zelle users for free. To receive money from someone else, you’ll need to have an email address and a U.S. mobile phone. You can send up to $10,000 through Zelle within seven days or up to $20,000 within thirty days.

How can I send money without fees?

New apps like Paypal and Zelle make it easy to send money to friends and family in a matter of minutes, with no fees. Western Union and MoneyGram can be used to send money to a different city, state, or country for a fee.

What are the pros and cons of PayPal?

Pros & Cons of PayPal for Small Businesses

| PROS | CONS |

|---|---|

| Secure means of sending payment | Popular target for phishing and scams |

| Diverse financing options | Poor customer service |

| Extensive online and in-person payment solutions | Digital purchases aren’t protected |

| Additional merchant support features | Disputes can delay refunds |

• Dec 15, 2021