Does Uber reimburse for insurance?

Collision and comprehensive coverage. If your personal insurance already includes this coverage, the insurance that Uber maintains will take its place to pay for damage to your vehicle (subject to a $2, 500 deductible)³.

Subsequently, How much does Uber eats pay for insurance?

UberEATs Coverage Limits Between Deliveries

| UberEATs Coverage Between Deliveries | Coverage Limit |

|---|---|

| Bodily Injury Liability | $50,000 for one person/$100,000 for more than one person in a single accident |

| Property Damage Liability | $25,000 for all property damage |

| Get Your Rates Quote Now |

Oct 8, 2021

Do I need to tell my insurance I drive for Uber eats?

Yes, you must tell your insurance provider that you drive for Uber Eats.

Will my insurance drop me if I drive for Uber?

Many private insurance policies specifically exclude driving for hire in their coverage. That means, Uber or Lyft drivers with such insurance policies are not covered while they’re driving for pay.

How much do Uber drivers make?

How Much Do Uber Drivers Actually Make? Uber’s pay structure factors in several variables: base fares, tips and other incentives. Calculating a realistic average is difficult. However, according to recent studies, most Uber drivers earn about $8 to $12 per hour.

What is Uber insurance deductible?

– As long as you maintain comprehensive and collision coverage on your personal auto insurance, Uber’s insurance will kick in and provide physical damage coverage for your car up to its actual cash value, regardless of who is at fault. There is a $2,500 deductible that you must pay first before this coverage applies. (

What’s the highest paid Uber driver?

Buzzfeed analyzed the pay of 11 full- and part-time Uber drivers. They made anywhere from $3.99 an hour to $31.44 an hour (after expenses). The second highest paid driver was a 21-year-old student who made $29.57.

How much does a 20 minute Uber cost?

The cost of a 20-minute Uber ride can cost as low as $20 on the low end to $50 on the high end. The variable cost will depend on the area, total mileage, and vehicle. The cost for a 20-minute ride in your area may not be the same as it is in another area.

Is it worth becoming an Uber driver?

Overall, driving for Uber is still a worthwhile side hustle for many people. You’re not going to get rich driving people around in your spare time, but it’s a flexible way to make extra money.

Does Geico have Rideshare insurance?

Geico offers rideshare insurance coverage that replaces your existing Geico policy. By converting your personal policy to a rideshare policy, you will be covered by the same insurance whether the rideshare app is on or off. This is required for Geico customers who drive for any rideshare service.

What is third party liability insurance?

Third-party liability coverage is the portion of an insurance policy that protects you if you’re sued (or threatened to be sued) for a physical injury or damage to someone else’s property.

What is LYFT deductible?

as long as you have obtained comprehensive coverage on your personal automobile policy. The contingent comprehensive coverage will apply up to the actual cash value of your vehicle or cost of repair, whichever is less, with a $2,500 deductible.

Does Uber Black make more money?

While Uber X drivers earn a modest base fare of $2.20, Uber Black drivers bring in nearly four times that amount at $8.00. Next, when you compare the two services’ per minute charges, Uber Black comes out on top at $0.65 per minute, nearly tripling Uber X’s $0.26.

What percentage does Uber take?

Uber charges partners 25% fee on all fares. This fee covers: The use of Uber software.

How do I maximize my Uber earnings?

7 Ways to Boost Your Uber Earnings

- Keep Snacks and Water Handy.

- Know the Local Bathrooms.

- Don’t Follow the Herd.

- Drive up the Surge Fares.

- Don’t Drive Around Endlessly.

- Don’t Chase Surge Fares (but If You Do, Try This Hack)

- Use the Uber Passenger App.

Is LYFT cheaper than Uber?

According to average ride costs, Uber is the cheaper company with the average trip costing $20 compared to the $27 you’d spend for an average Lyft trip.

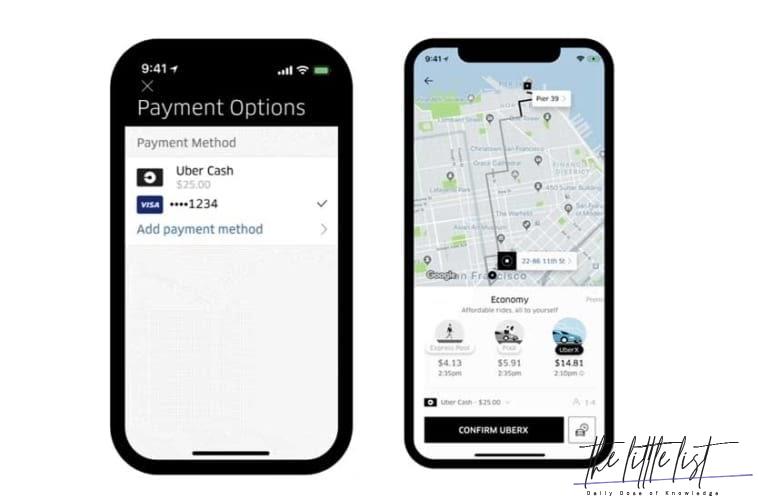

Can you pay Uber with Cash?

Can I pay for Uber with cash? Yes, you can pay with cash. Before requesting a ride, go to the Payment section in the app and select Cash. At the end of your trip, pay cash directly to your driver.

Do you sit in back or front of Uber?

Whenever possible, sit in the back seat, especially if you’re riding alone. This helps ensure that you can safely exit on either side of the vehicle to avoid moving traffic, and it gives you and your driver some personal space.

Who pays better Uber or Lyft?

If you’re simply looking at which company’s drivers make more, Lyft’s hourly average of $17.50 is higher than Uber’s average of $15.68. Lyft also boasts better driver satisfaction.

Is Uber a good side hustle?

While it certainly has competitors (think: Lyft), Uber is one of the most flexible side hustles anyone can find.

Will USAA cancel my insurance if I drive for Uber?

Answer provided by. “If you’re currently insured with USAA, you should be able to add their ridesharing gap coverage onto your personal auto policy. USAA’s rideshare insurance covers the gap between your personal auto policy and the ridesharing app’s coverage.

Can you use Geico for Uber?

Yes, you can drive for Uber with Geico insurance. Most other insurance companies strictly forbid “drive for hire” activities like driving for Uber, but Geico’s hybrid insurance policy provides coverage while rideshare driving. You are not limited to just Uber.

Is DoorDash considered Rideshare?

Bottom line on rideshare income taxes

Driving for a rideshare (such as Lyfy or Uber) or food delivery (including Doordash) can sometimes be a good way to gross a few dollars in an emergency.

What happens if you don’t have third party insurance?

If the at-fault party has comprehensive or third party property insurance, then their insurer will cover the cost of repairs. If the at-fault party doesn’t have any insurance to cover property damage, then they will be personally liable for the cost of repairing your vehicle.

What type of damage is not covered by third party insurance?

Damage to your own vehicle. Damage to someone else’s vehicle. Personal injury.

What happens if you only have third party insurance?

Third party property insurance generally only covers damages caused to 3rd parties by your negligence. It does not cover damage to your own property. If you receive a demand for damages allegedly caused by you, you should contact your insurer and make a claim.

Can Uber drivers write off their car payment?

You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving.

Can Uber drivers claim car expenses?

Along with these expenses, you can claim additional costs that are directly related to becoming and operating as an Uber driver, such as: Work-related parking expenses (keep receipts and add them up, or claim up to $200 a year for your parking charges less than $10 each)

Do Uber drivers pay into Social Security? Self-employment Taxes

The first of the two taxes for rideshare drivers is the self-employment tax. Rideshare drivers will pay self-employment taxes if you’ve earned $400 or more. The self-employment tax is at a rate of 15.3% of your income, which pays for Medicare and Social Security.