Do I need to report DoorDash income if less than 600?

Yes. You are required to report and pay taxes on any income you receive. The $600 threshold is not related to whether you have to pay taxes. It’s only that Doordash isn’t required to send you a 1099 form if you made less than $600.

Then, Does DoorDash mess up your taxes?

A 1099-NEC form summarizes Dashers’ earnings as independent contractors in the US. It’s provided to you and the IRS, as well as some US states, if you earn $600 or more in 2021. If you’re a Dasher, you’ll need this form to file your taxes.

How much should I set aside for taxes DoorDash?

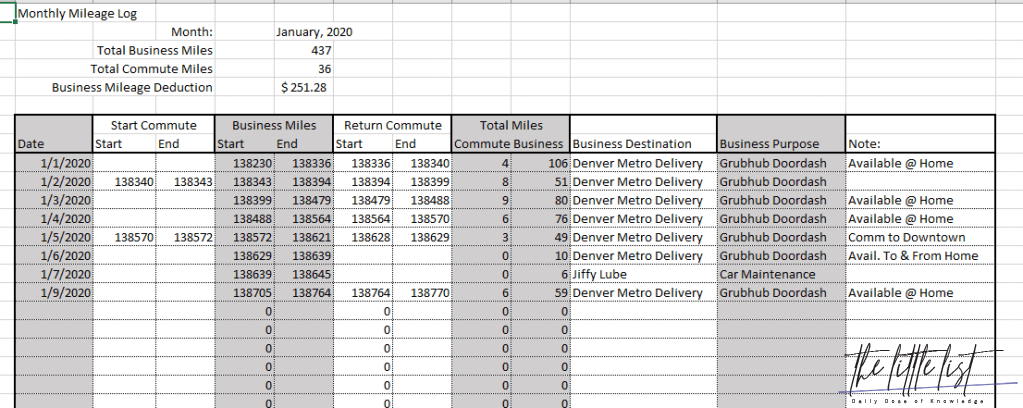

Personally, when I’m estimating how much to save for Doordash taxes (and other gigs), I make it really quick and easy. I just subtract 56¢ per mile from my earnings (2021) There are other expenses, but they pale in comparison to the standard mileage deduction.

Can you make 200 a day with DoorDash?

If you plan on working 7 days per week, and assuming an average of 30 days per month, you will need to make $133 per day to reach that goal. If you plan on working just Monday through Friday, that raises your daily number to $200 per day.

How much should I put aside for taxes DoorDash?

Generally, you should set aside 30-40% of your income to cover both federal and state taxes. Whether you file your taxes quarterly or annually, you need to set aside a portion of your income for your taxes.

Can I use my DoorDash red card for gas?

You cannot use the Doordash driver red card for gas or for yourself or personal use. In addition, the card has no funds when you do not accept a delivery request and need to pick up an order.

Does DoorDash pay you for mileage?

DoorDash doesn’t pay for its delivery drivers’ mileage. This is because when you deliver for DoorDash, you’re an independent contractor, and therefore are responsible for providing your own car, its repairs, gas, mileage, etc.

What happens if you dont report DoorDash income?

With zero withheld, your taxes will pile up and you will have a big tax bill due Tax Day. If you cannot pay the full amount, you will face penalties and owe interest. Another option is to pay quarterly estimated payments direct to the IRS.

Can I use DoorDash card for gas?

No, first of all, Dashers are independent contractors. DoorDash, as well as Lyft, Uber, or Postmates, don’t pay for gas or tickets for car maintenance. You cannot use the Doordash driver red card for gas or for yourself or personal use.

How do I make $1000 a week with DoorDash?

To make $1000 a week driving for DoorDash, you must have a consistent presence. It’s like that in any game, right? If you don’t put in the effort, you won’t get the returns. Once you figure out the best times for you to drive, create a schedule that will give you a minimum of three to four hours a day of driving.

Is DoorDash worth after gas and taxes?

Plus, as an independent contractor, you can potentially claim some operational expenses like your mileage to help you out on your tax return. In this sense, DoorDash is worth it after taxes, but it’s important to keep track of your income and expenses so you can accurately report your earnings.

Does DoorDash give you bonuses?

If you earn $2500, DoorDash will add $250. Your total earnings for these deliveries will then be the $2750 guarantee. If you earn $3000, however, you exceeded the minimum guarantee and will not be eligible for additional earnings through this program.

Does DoorDash give you gas money?

All U.S. Dashers who deliver by motor vehicle will be eligible to qualify for the Weekly Gas Bonus. Stay tuned for more information if you dash outside of the US. All U.S. Dashers who are approved for a DasherDirect card can get 10% cash back on gas purchases. Learn how to sign up today.

Do I have to pay quarterly taxes DoorDash?

Since you’re an independent contractor, you might be responsible for estimated quarterly taxes—especially if DoorDash is your sole source of income. Make sure to pay estimated taxes on time. Each quarter, you’re expected to pay taxes for that quarter’s payment period.

How many times can you cash out with DoorDash?

Yes, you can cash out at any time, up to once per day. Do note that any earnings in your balance that you don’t cash out by midnight on Sunday will be deposited in your bank account (with a 2-3 day processing period) as a weekly direct deposit.

What is a hot bag DoorDash?

In order to ensure standards of food safety, merchants may require all Dashers to have an insulated hot bag during their deliveries. You may use any hot bag of your choice. To get a DoorDash hot bag, you can purchase one online at www.doordashstore.com.

Can you DoorDash before you get your activation kit?

Can You Start DoorDash Without an Activation Kit? You have to complete your first order as a dasher before you receive your welcome kit.

Can you make $500 a week with DoorDash?

Example of Guaranteed Earnings offer: “Earn at least $500 in total earnings for 50 deliveries in the next week.” Example: If you complete a minimum of 50 deliveries within 7 days as an active Dasher, you will earn at least $500.

Can you write off car payments for DoorDash?

Careful—you can’t deduct both mileage and gas at the same time! The standard mileage deduction (56 cents per mile in 2021 and 58.5 cents per mile in 2022) is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation.

Can someone ride with you while you DoorDash?

Yes, as an independent contractor there are no rules against having any passengers, including friends!

Is being a DoorDash driver worth it?

The reality is that DoorDash is an effective side hustle, and again, DoorDash states the average hourly pay is $23 per hour. So, if you can get lucky with tips and peak pay, I think it’s possible to sometimes make $20 to $30 per hour with this side hustle.

How do you make 500 a day on DoorDash?

What’s the most you’ve made in a day with DoorDash?

There will be repair expenses down the road if you drive that many hours. Of course, if you only hustle after work a few hours, you’re probably looking at making $50 to $100 per day with DoorDash.

What delivery service pays the most?

10 best paying food delivery services

- Instacart. Salary: the typical Instacart delivery driver earns $29 per hour1 and about $25,165 per year6.

- Shipt.

- Uber Eats.

- Amazon Flex.

- 5 DoorDash.

- Postmates.

- Caviar.

- Grubhub.

How much can you make with DoorDash after expenses?

➡️ On average, DoorDash pays just $1.45 per hour worked, after accounting for the expenses of mileage and the additional payroll taxes borne by independent contractors. The average job requires 6.8 miles of driving, and takes 30 minutes to complete.